Short-stay accommodation offered via online collaborative economy platforms - monthly data

Data extracted in March 2024

Planned article update: 3 July 2024

Highlights

Platforms record more than 678 million nights spent in short stay accommodation in 2023.

Nights booked via online platforms up by 13.8 % in 2023 compared with 2022.

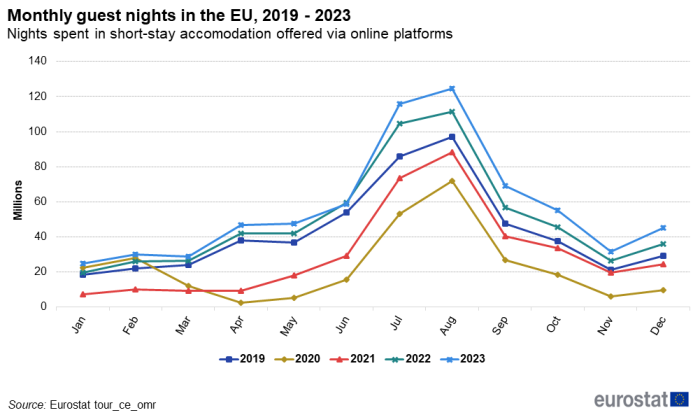

In the fourth quarter of 2023, nights spent in accommodation booked via online platforms continued to exceed the values recorded in previous years. The highlight figure above shows that platform tourism had already recovered during 2022, with guest nights spent reaching or exceeding the pre-Covid-19 pandemic baseline (2019) every month. August 2022 was the first individual month with more than 100 million guest nights booked. This development continued and intensified in the fourth quarter of 2023 with a record amount of guest nights in each month. In October, 55.3 million nights were spent in accommodation booked via online platforms, showing an increase of 21.9 % compared with October 2022. In November, this number decreased to 31.8 million nights (+20.0 % compared to November 2022) and in December, that number was 45.3 million (+25.8 % compared with December 2022).

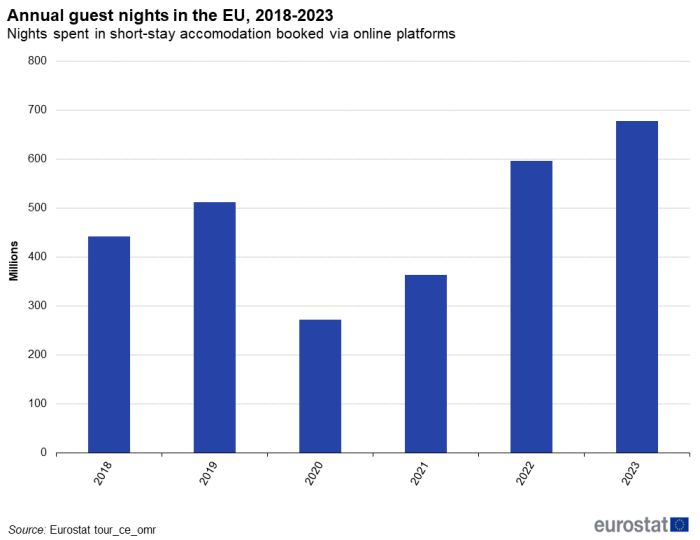

This means that in total, in 2023, 678.6 million guest nights were spent in short stay accommodation booked via one of the four platforms, an increase of 13.8 % compared with 2022. This is the third year in a row with a double-digit year-to-year increase, although the growth has slowed since the contraction suffered in 2020 due to the Covid-19 pandemic has been overcome already in 2022 (2021: +33.9 %, 2022: +63.9 %).

This article accompanies the more detailed articles covering the annual data release for 2022, and the impact of the Covid-19 pandemic on reference years 2020 and 2021. It is updated four times per year, at the beginning of each quarter, and focusses on nights spent at country and regional level (NUTS 2).

Full article

22.7 % growth of platform tourism in Q4 2023

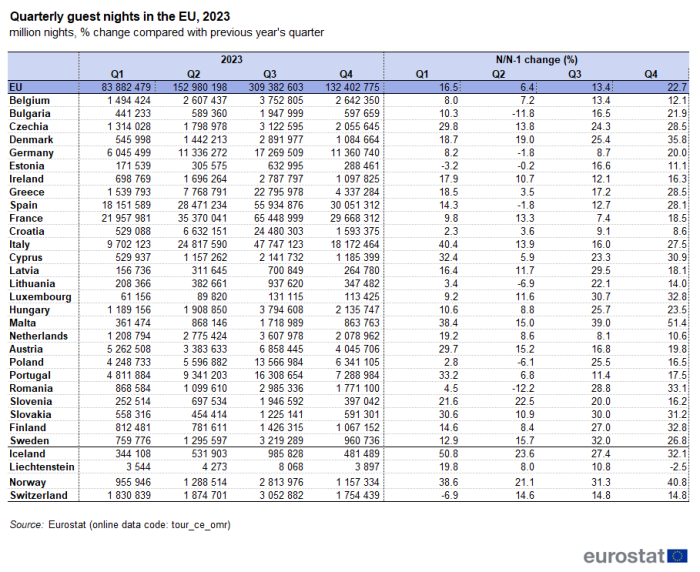

In total, between October and December 2023, 132.4 million nights were spent in beds booked through one of the four online collaborative economy platforms which have a data sharing agreement with Eurostat (Airbnb, Booking, Tripadvisor and Expedia), an increase of 22.7 % compared with 2022. This increase comes on top of the already substantive recovery recorded in Q4 2022, when guest nights were already exceeding the pre-Covid-19 pandemic baseline value.

While comparisons with 2022 document a strong, positive development in all countries except Liechtenstein, Table 1 shows that growth rates in the individual countries were rather variable. For Q4 2023, growth rates among EU Member States ranged from 8.6 % in Croatia to 51.4 % in Malta, with an EU-wide growth of 22.7 %. Spain, France and Italy, the most popular destination countries in Q4 2023, reached growth rates of 28.1 %, 18.5 % and 27.5 %, respectively. During the preceding quarter, Q3 2023, the EU average growth was 13.4 %, with country values between 7.4 % in France and 39.0 % in Malta. In Q2 2023, the EU average growth was 6.4 %, with country values between -12.2 % in Romania and 22.5 % in Slovenia. During Q1 2023, the overall EU growth rate was 16.5 %, ranging from -3.2 % in Estonia to 40.4 % in Italy.

Source: Eurostat tour_ce_omr

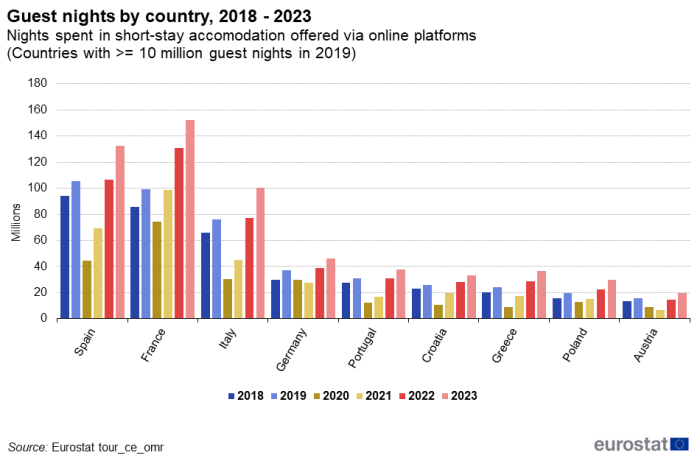

Looking at the nine most popular EU destination countries (defined here as countries with at least 10 million guest nights in 2019), it becomes clear that platform tourism in all nine countries benefitted from the overall growth in the sector in Q4 2023. The number of guest nights in all nine countries has grown compared to 2022 and all of them far exceed their pre-pandemic levels.

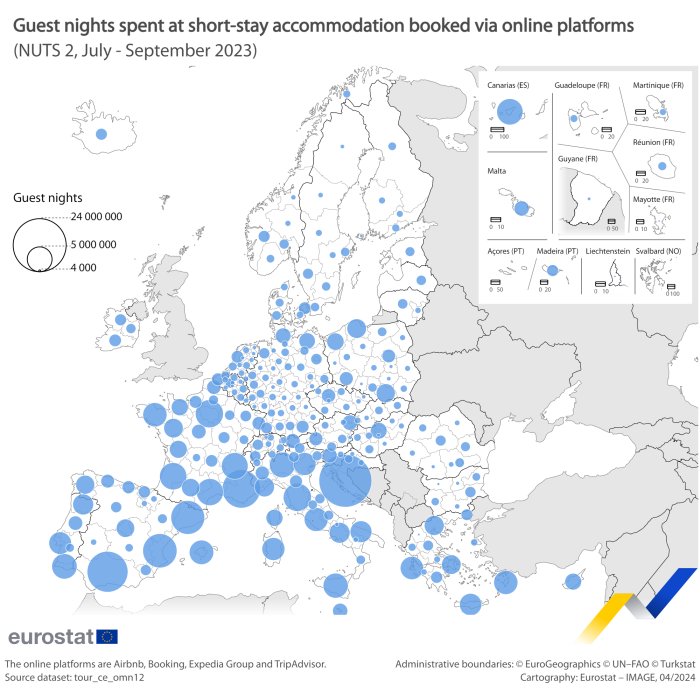

Croatian, Spanish and French regions most popular in Q3 2023

Source: Eurostat (tour_ce_omn12)

Note: Due to the nature of Eurostat's agreement with the partner platforms, monthly regional data is released 3 months after the country level data. Therefore, while the content above refers to data up to and including December 2023, the regional data below only refers to data up to and including September 2023.

The most popular regions for short-term rental accommodation booked via online platforms in the third quarter of 2023 were Jadranska Hrvatska in Croatia (23.7 million nights), Andalucía in Spain (14.0 million nights), and the French Provence-Alpes-Côte d’Azur (12.2 million nights).

In the top 20 regions, 6 were in France, 5 each in Spain and Italy, 2 in Greece and 1 region each in Croatia and Portugal.

Feedback

To help Eurostat improve these experimental statistics, users and researchers are kindly invited to give us their feedback by email

Data sources

The article is based on data provided to Eurostat by four international platforms (Airbnb, Booking.com, Expedia Group, Tripadvisor), following agreements on data exchange concluded early 2020. The data covers short-stay accommodation in the EU Member States and EFTA countries, offered by service providers via one of these four online collaborative economy platforms.

Both the article and the data only refer to the accommodation offered through the four platforms, and can – due to possible overlaps – not be added to other tourism statistics on holiday rentals or other types of accommodation such as hotels, available via European statistics on tourist accommodation. Additionally, only merged data for the four platforms is released: no data on individual platforms is disclosed.

This article uses data that are published as experimental statistics. Such statistics use new data sources or methods to match user needs, but have not yet reached the maturity of fully-fledged official statistics. The project pioneers Eurostat's use of privately held data via a direct cooperation with the industry, to produce reliable data covering the entire EU in a coherent way.

Scope and key concepts

- Scope: the data covers holiday rentals (excluding hotels and campsites) offered via four online collaborative economy platforms.

- Number of guest nights: number of nights spent during a stay, taking into account the size of the travel party; this article mainly focuses on this concept (e.g.: a family of four staying 3 nights in an apartment represents 1 stay, 3 nights and 12 guest nights).

Context

The collaborative economy also called the sharing economy covers a great variety of sectors and is rapidly growing across Europe. In the tourism sector the collaborative economy provides many exciting opportunities for citizens as consumers, as well as for micro-entrepreneurs and SMEs. At the same time its rapid development has led to challenges, particularly in popular tourist destinations. As a result, cities and other communities are seeking to strike a balance between promoting tourism with the economic benefits it brings and maintaining the integrity of local communities. To promote a balanced development of the collaborative economy the Commission issued guidelines to EU Member States in 2016 on how existing EU rules apply to the collaborative economy. A series of workshops in 2017 and 2018 identified policy principles and good practices specifically on collaborative short-term accommodation services.

In March 2020, the Commission reached a landmark agreement with Airbnb, Booking.com, Expedia Group and Tripadvisor on data sharing. The agreement, signed between each platform and Eurostat on behalf of the European Commission, allows Eurostat to obtain key data from the four collaborative platforms and publish key statistics on short-term accommodation rentals concluded through these platforms on its website. In particular, platforms agreed to share, on a continuous basis, data on the number of nights booked and the number of guests. The privacy of citizens, including guests and hosts, is protected in line with applicable EU legislation and data will not allow individual citizens or property owners to be identified. The data provided by the platforms is then subject to statistical validation and aggregated and published by Eurostat.

The agreement has allowed, for the first time, access to reliable data about holiday and other short-stay accommodation offered via these collaborative economy platforms. It helps to close an information gap, since data on holiday homes, apartments and rooms in otherwise private buildings are often outside the scope of existing tourism registers.

Direct access to

See also

Database

- Tourism (tour), see:

- Accommodation offered via collaborative economy platforms - experimental data (tour_ce)

- Occupancy - monthly data (tour_ce_om)

Dedicated section

Methodology