Short-stay accommodation offered via online collaborative economy platforms

Data extracted in January 2024 (unscheduled update due to data revision)

Planned article update: 1 July 2024

Highlights

In 2022, almost 597 million nights were booked via collaborative economy platforms – Paris was the most popular city.

Platform tourism exceeds pre-pandemic baseline in 2022, but city destinations still less popular than in 2019.

The collaborative economy had a significant impact on the tourist accommodation market in the past decade. Online platforms make it easier for service providers to advertise their rooms or apartments to potential guests and this easier access to the market, for owners as well as for guests, increased the attention for this segment of the market. An agreement between the European Commission and four large online collaborative economy platforms (Airbnb, Booking, Expedia Group and Tripadvisor), signed in March 2020, allows Eurostat to compare guest nights spent in short-stay accommodation offered via online platforms from 2018 onwards. The expression “platform tourism”, used throughout this article, refers to short-term rentals, such as apartments, booked through these four platforms, excluding other forms of accommodation, such as hotels or campsites.

The Covid-19 pandemic had major impacts on all sectors of tourism between 2020 and 2022, but platform tourism has rebounded and is exceeding pre-pandemic levels. This article focuses on national, regional and city level data on guest nights spent in 2022, but a separate article focusing on the impact of the pandemic is available as well. Finally, a shorter article focusing on monthly data which is updated quarterly is also available.

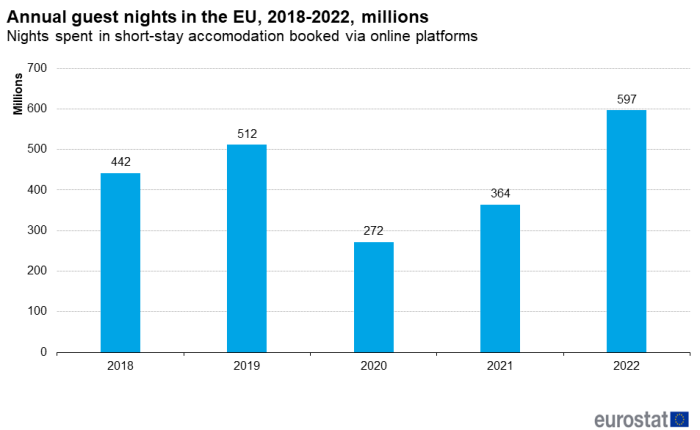

In 2022, 597 million guest nights were spent in accommodation booked via one of the four platforms, compared to 364 million in 2021 and 512 million in 2019. This means that the recovery started in 2021 continued in 2022 with a growth of around 64 % compared to the previous year. Compared with the pre-pandemic baseline of 2019, the growth was still around 17 % (see figure 1).

Full article

In 2022, more than 1.6 million tourists per night slept in a bed booked via the platforms

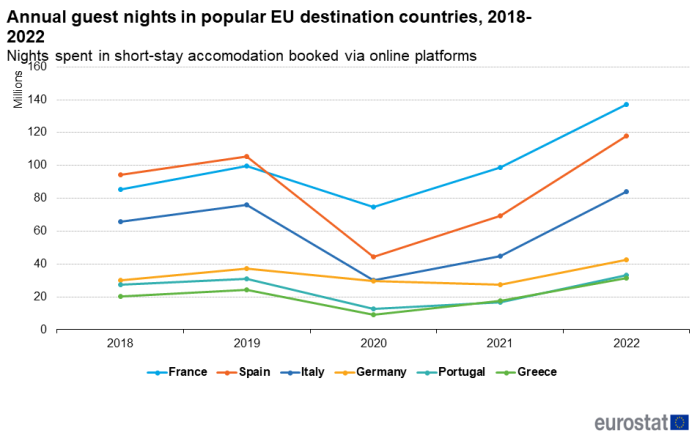

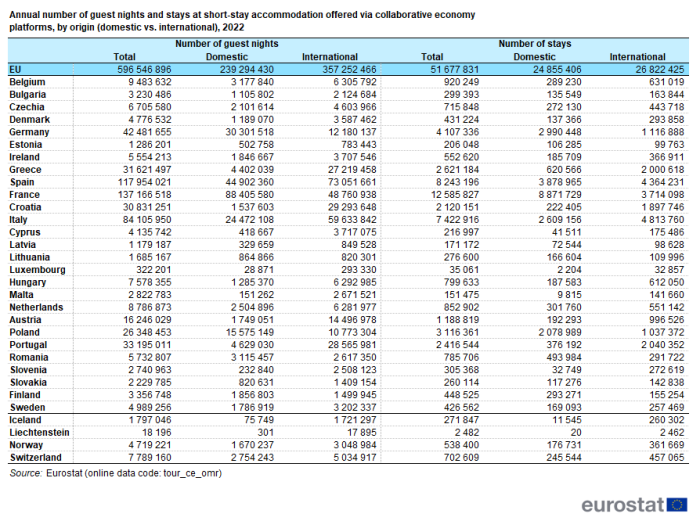

In 2022, almost 597 million guest nights spent in the European Union (EU) were booked via one of the four platforms, (see table 1 and figure 1), or on average 1.63 million guests each day. The number of guest nights takes into account the number of nights spent during a stay and the number of tourists in the travel party. The concept is similar to the "nights spent at tourist accommodation establishments" generally used in official tourism statistics, and will be the focal volume indicator in this article. Almost one quarter of these nights were spent in France (137 million guest nights), followed by Spain (118 million). Italy (84 million guest nights), Germany (42 million) and Portugal (33 million) complete the top five. Additional countries with over 10 million guest nights recorded in 2022 were Greece (32 million), Croatia (31 million guest nights), Poland (26 million) and Austria (16 million).

After the pre-pandemic record year of 2019 with 512 million guest nights spent, the pandemic lead to a huge contraction by 47 % in 2020 (272 million), followed by the beginnings of a recovery in 2021 (364 million; + 34 %). In 2022, the pre-pandemic baseline was exceeded for the first time. This general picture remains true when looking at the most popular countries (see figure 2), however, it becomes clear that the pandemic did not have the same impact in all countries. The decrease was much less pronounced in countries with a large share of domestic guests such as France and Germany (see table 1). Nights spent in France exceeded nights spent in Spain for the first time in 2020, and France has remained in the top spot since, exceeding its 2019 values by around 38 %.

In the EU, six out of every ten guest nights were spent by a tourist from another country (357 million guest nights, or 59.9 %). However, this share has decrease when compared with pre-pandemic times (67 % in 2019). In 6 out of the 31 EU and EFTA countries in the analysis, the share of international guest nights exceeded 90 % (see table 1 and figure 3). In three countries, Liechtenstein, Iceland, and Croatia, the international share was 95 % or over.

Looking at another indicator, the 597 million guest nights spent in the EU during 2022 represented 52 million stays (see table 1). This means that each minute, around 100 stays were booked and each day more than 140 000. The highest number of stays were recorded in France (12.6 million stays), Spain (8.2 million stays) and Italy (7.4 million stays). These three countries accounted for more than half of the total number of stays in 2022.

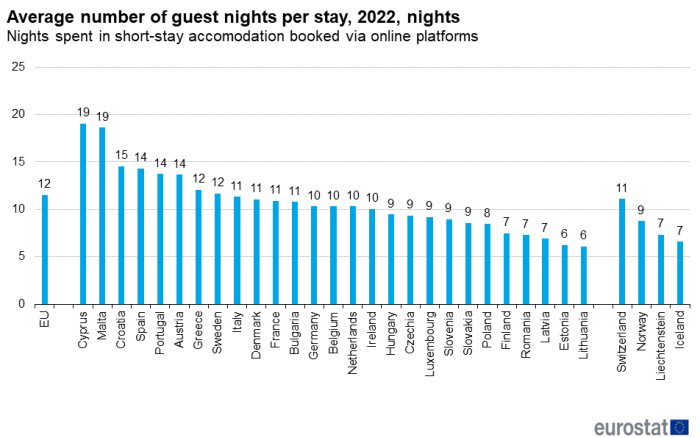

On average in the EU, throughout 2022, one booking or stay represented 12 guest nights (see Figure 4). The highest number of guest nights per stay (not to be confused with the average duration of the stay, which does not take into account the number of guests) was observed in the southern countries Cyprus, Malta (19 guest nights per stay), Croatia (15 nights), Spain, Portugal and Austria (14 nights). At the other end of the spectrum, a stay at a destination in Estonia or Lithuania, led to, on average, no more than 6 guest nights. Over time, the average length of stays has increased by around 0.6 guest nights since 2019.

More than one in three guest nights was spent in the peak months July and August

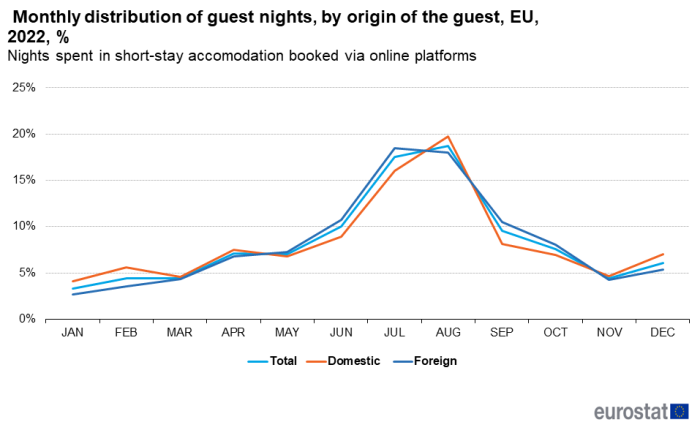

Seasonality in tourism generally peaks in the two summer months of July and August, and this is no different for the accommodation booked via online platforms. More than 36 % of guest nights spent during 2022 occurred in July (18 %) and August (19 %) (see figure 5). The slowest months were January, February, March and November, each accounting for around 3-5 % of the total number of guest nights spent during 2022.

In all EU and EFTA countries, July and August are the two busiest months, but the level of seasonality (measured as the share of July and August in the total guest nights spent during the year) is highest in Croatia (62 % of annual guest nights recorded in July or August), Slovenia (49 %), Greece (48 %) and Bulgaria (43 %) (see figure 6). In Luxembourg (22 %), Finland (26 %), Belgium (26 %) and Germany (27 %), the two summer months were less dominant.

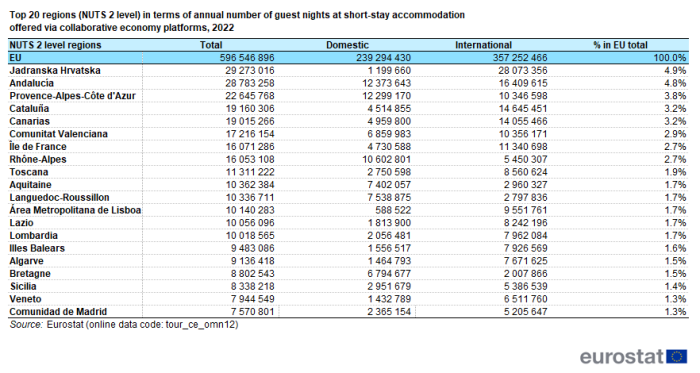

The 20 most popular regions account for nearly half the total guest nights

The 27 Member States of the EU are divided in 242 statistical regions (NUTS 2 level, see highlight figure). In 2022, in 14 of these regions the number of guest nights spent at accommodation facilities booked via the four platforms exceeded 10 million guest nights. In 3 regions, more than 20 million annual guests nights were recorded: Jadranska Hrvatska (Adriatic Croatia, 29 million), Andalucia (29 million) and Provence-Alpes-Côte d'Azur (23 million). Together, these three regions accounted for almost 14 % of the guest nights spent in the EU that were reserved via the platforms. The 20 most popular regions account for nearly half (47 %) of the total number of guest nights spent via the platforms (see table 2), most of these top 20 regions are located in Spain (7 regions), France (6), or Italy (5). Croatia and Portugal have one region each in the top 20.

The development over time of the six most popular regions shows not a lot of relative movement. All regions except Cataluña have exceeded their pre-pandemic baseline, as a result, Provence-Alpes-Côte d'Azur has overtaken Cataluña and is now the third most popular region.

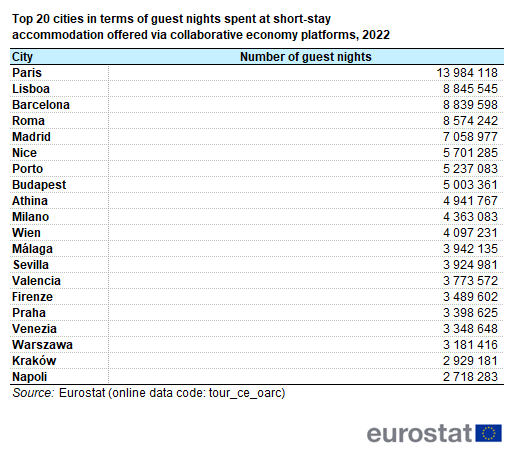

Paris was the most popular city

The four platforms send data to Eurostat at the level of Local Administrative Units (LAUs), the data can be aggregated to the level of the most significant cities in Europe. In the EU and EFTA, 46 cities recorded more than one million guest nights in 2022 (see table 3 for the top 20). The top city destinations for tourists booking their accommodation through one of the four platforms were Paris (14.0 million guest nights, or more than 38 000 guests on an average night), Lisbon (8.8 million), Barcelona (8.8 million), Rome (8.6 million) and Madrid (7.1 million). Taken together, these five cities account for around 8 % (47.3 million) of all nights spent in the EU booked via the four platforms (597 million).

Looking once again at the development over time of the most popular cities (figure 8), it becomes clear that the popularity of city tourism has suffered as a consequence of the pandemic. All cities except Paris are still far behind their pre-pandemic records and the relative strength of Paris has to be seen in the context of the overall strong growth in France (France: +38 % since 2019, Paris: +3.4 %).

When considering the local population figures, the European cities that had, on an average night in 2022, the highest ratio of tourists staying in platforms-listed accommodation as compared to local residents, were Benidorm, Benalmádena and Marbella in Spain (6.8 %, 5.1 % and 4.0 %), as well as Zadar and Pula in Croatia (5.5 % and 4.7 %) (see table 4). To put these values in perspective, this ratio is 0.37 % for the EU as a whole.

Feedback

To help Eurostat improve these experimental statistics, users and researchers are kindly invited to give us their feedback by email

Source data for tables and graphs

Data sources

The article is based on data provided to Eurostat by four international platforms (Airbnb, Booking, Expedia Group, Tripadvisor), following agreements on data exchange concluded early 2020. The data covers short-stay accommodation in the EU and EFTA countries, offered by service providers via one of these four online collaborative economy platforms.

Both the article and the data only refer to the accommodation offered through the four platforms, and can – due to possible overlaps – not be added to other tourism statistics on holiday rentals or other types of accommodation such as hotels, available via European statistics on tourist accommodation. Additionally, only merged data for the four platforms is released: no data on individual platforms is disclosed.

This article uses data that are published as experimental statistics. Such statistics use new data sources or methods to match user needs, but have not yet reached the maturity of fully-fledged official statistics. The project pioneers Eurostat’s use of privately held data via a direct cooperation with the industry, to produce reliable data covering the entire EU in a coherent way.

Scope and key concepts

- Scope: the data covers holiday rentals (excluding hotels and campsites) offered via four online collaborative economy platforms.

- Number of stays: number of times a facility offered via the platforms was occupied.

- Number of nights: number of nights a facility offered via the platforms was occupied

- Number of guest nights: number of nights spent during a stay, taking into account the size of the travel party; this article. mainly focuses on this concept (e.g.: a family of four staying 3 nights in an apartment represents 1 stay, 3 nights and 12 guest nights).

- Domestic guest nights: guest nights spent by tourists who are residents of the country visited.

- International guest nights: guest nights spent by tourists who are non-residents to the country visited.

- Cities are those local administrative units (LAU) where at least 50 % of the population lives in an urban centres; an urban centre is a cluster of contiguous grid cells of 1 km2 with a density of at least 1 500 inhabitants per km2 and collectively a population of at least 50 000 inhabitants. A city can be composed of several local administrative units. For the purpose of these statistics, only ‘selected cities’ are considered, namely those cities that fulfil at least one of the following criteria: i. capital cities ; ii. cities having at least 200 000 inhabitants ; iii. other cities in a country that, jointly, account for 90 % of annual guest nights spent in cities of that country. Further information on the delineation of the ‘selected cities’, namely which local administrative units they comprise, can be found

here.

here.

Context

The collaborative economy , also called the sharing economy, covers a great variety of sectors and is rapidly growing across Europe. In the tourism sector, the collaborative economy provides many exciting opportunities for citizens as consumers as well as for micro-entrepreneurs and SMEs. At the same time, its rapid development has led to challenges, particularly in popular tourist destinations. As a result, cities and other communities are seeking to strike a balance between promoting tourism, with the economic benefits it brings, and maintaining the integrity of local communities. To promote a balanced development of the collaborative economy, the Commission issued guidelines to EU countries in 2016 on how existing EU rules apply to the collaborative economy. A series of workshops in 2017 and 2018 identified policy principles and good practices specifically on collaborative short-term accommodation services.

In March 2020, the Commission reached a landmark agreement with Airbnb, Booking, Expedia Group and Tripadvisor on data sharing. The agreement, signed between each platform and Eurostat on behalf of the European Commission, allows Eurostat to obtain key data from the four collaborative platforms and publish key statistics on short-term accommodation rentals concluded through these platforms on its website. In particular, platforms agreed to share, on a continuous basis, data on the number of nights booked and the number of guests. The privacy of citizens, including guests and hosts, is protected in line with applicable EU legislation and data will not allow individual citizens or property owners to be identified. The data provided by the platforms is then subject to statistical validation and aggregated and published by Eurostat.

The agreement has allowed, for the first time, access to reliable data about holiday and other short-stay accommodation offered via these collaborative economy platforms. It helps to close an information gap, since data on holiday homes, apartments and rooms in otherwise private buildings are often outside the scope of existing tourism registers.

Direct access to

See also

Database

- Tourism (tour), see:

- Accommodation offered via collaborative economy platforms - experimental data (tour_ce)

- Occupancy - monthly data (tour_ce_om)

Dedicated section

Methodology