Extra-EU trade in raw materials

Data extracted in March 2023.

Planned update: 14 May 2024.

Highlights

Since 2002 the EU has had an ongoing trade deficit in raw materials including goods such as oilseeds, cork, wood, pulp, textile fibers, ores and other minerals as well as animal and vegetable oils .

Brazil and the United States were the largest partners for EU imports of raw materials in 2022.

China and the United Kingdom were the largest partners for EU exports of raw materials in 2022.

EU trade in raw materials, 2002-2022

Trade in raw materials is extremely important for the sustainability of European countries and their economies. Construction, chemicals, the automotive and aerospace industries, machinery and equipment are some of the sectors that are most dependent on access to raw materials.

This article is part of an online publication providing recent statistics on international trade in goods, covering information on the EU's main partners, main products traded, specific characteristics of trade as well as background information.

Full article

General view on EU trade in raw materials

In 2022, the value of total trade (import plus exports) of raw materials between the EU and the rest of the world was €201 billion. Since exports (€76 billion) were lower than imports (€125 billion) there was trade deficit of €49 billion. Between 2002 and 2022, EU trade in raw materials more than tripled, equivalent to an average annual growth of 5.9 %. In this period, exports (6.5 %) grew faster than imports (5.6 %), see Figure 1.

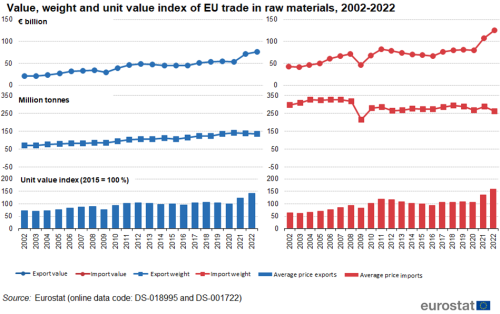

Figure 2 gives an overview of the value, weight and average price (as measured by the unit value index[1] of imports and exports of raw materials from 2002 to 2022). During this period, EU imports were higher than exports, both in value and in weight.

In value and weight EU exports from 2002 to 2008 followed the same trend. However, in 2009 weight remained stable while value declined. Between 2010 and 2020 both value and weight increased while unit values were more or less stable. However in 2021 and 2022, value increased significantly, due to a substantial increase of unit values.

For EU imports the decline in 2009 was stronger than for exports. From 2009 to 2011 weight and especially value increased. Between 2012 and 2016 values declined but between 2016 and 2020 they recovered and in 2021 and 2022 they increased strongly, due to a substantial increase of unit values.

Raw materials by product group

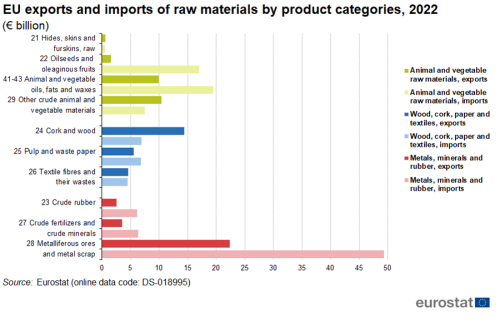

Raw materials can be subdivided in three main groups: animal and vegetable raw materials and wood, paper and textiles, metals, minerals and rubber (see Figure 3). In exports, the largest group was metals, minerals and rubber (38 %) followed by wood, paper and textiles (32 %) and animal and vegetable raw materials (30 %). In imports, the largest group also was metals, minerals and rubber (50 %) followed by animal and vegetable raw materials (36 %) and wood, paper and textiles (15 %).

Each of the categories discussed above can be subdivided into subgroups (see Figure 4).

In 2022, the largest subgroup in imports of animal and vegetable raw materials was animal and vegetable oils, fats and waxes with 44 % of imports. Also with 44 %, it was the second largest group in exports just behind other crude animal and vegetable materials with 46 %.

In wood, cork, paper and textiles, the largest subgroup was cork and wood with 59 % of exports. In imports it shared first place with pulp and waste paper, both having 38 %.

Metaliferous ores and metal scrap accounted for more than three quarters of the trade in the metals, minerals and rubber group. Its share in exports (78 %) was lower than in imports (80 %).

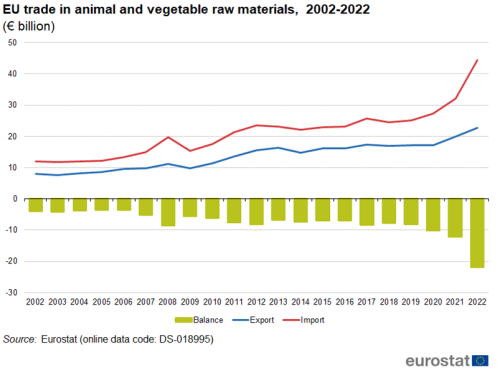

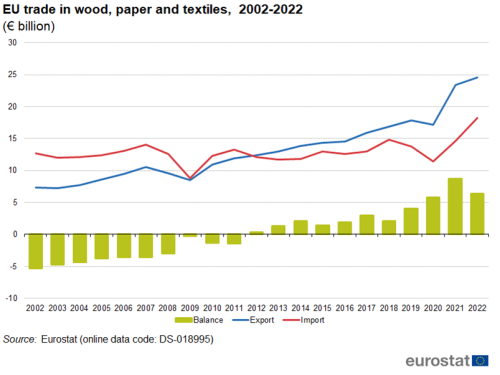

Figures 5, 6 and 7 show the exports, imports and trade balance over time for the three product groups.

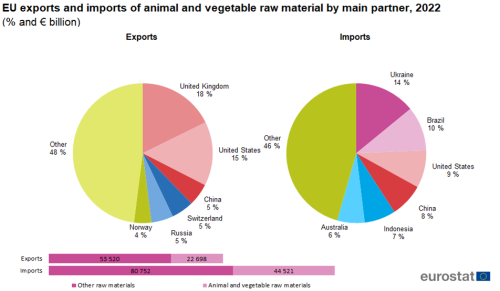

In 2022, the value of total trade (import plus exports) of animal and vegetable raw materials between the EU and the rest of the world was €67.2 billion (see Figure 5). Since exports (€22.7 billion) were lower than imports (€44.5 billion) there was a trade deficit of €21.8 billion. Between 2002 and 2022, EU trade in animal products more than tripled, equivalent to an average annual growth of 6.2 %. In this period, imports (6.8 %) grew faster than exports (5.3 %).

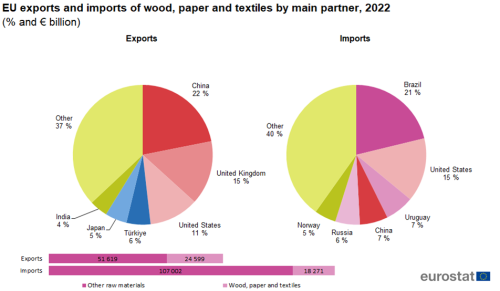

In 2022, the value of total trade (import plus exports) of wood, cork, paper and textiles between the EU and the rest of the world was € 42.9 billion (see Figure 6). Exports (€24.6 billion) were higher than imports (€18.3 billion), resulting in a trade surplus of €6.3 billion. Between 2002 and 2022, EU trade in wood, cork, paper and textiles more than doubled, equivalent to an average annual growth of 3.9 %. In this period, exports (6.2 %) grew much faster than imports (1.8 %).

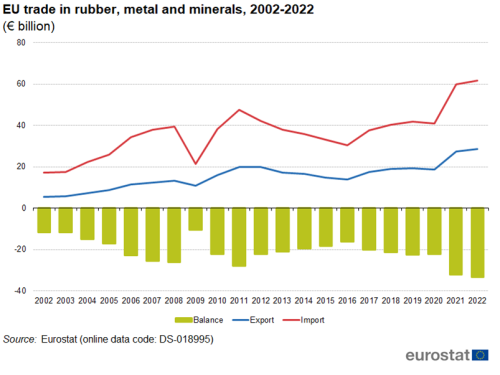

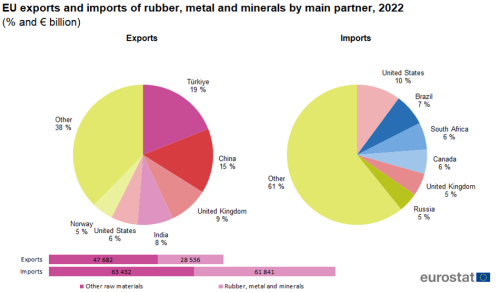

In 2022, the value of total trade (import plus exports) of metals, minerals and rubber between the EU and the rest of the world was €90.4 billion (see Figure 7). Since exports (€28.5 billion) were lower than imports (€61.8 billion) there was a trade deficit of €33.3 billion. Between 2002 and 2022, EU trade in metals, minerals and rubber quadrupled, equivalent to an average annual growth of 7.1 %. In this period, exports (8.5 %) grew faster than imports (6.6 %).

EU trade partners for raw materials

Figures 8 to 11 show the main partners of the EU for trade in raw materials in total and separately for the three product groups. Each figure shows the shares of the six main partners and is accompanied at the bottom by two bars showing the exports and imports in absolute values. The United States appears in all these figures as a top six partner for both exports and imports.

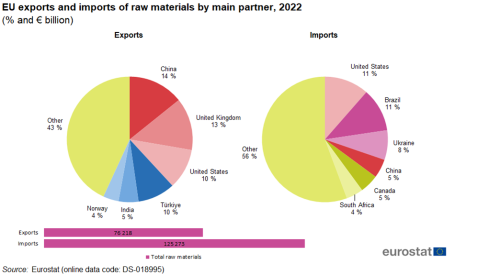

China was the main export destination of raw materials (Figure 8) with 14 % all exports in 2022,followed by the United Kingdom (13 %), Turkey and the United States (both 10 %). The top six export partners accounted for 57 % of all exports. The United States and Brazil (both 11 %) were the largest partners for imports, followed by Ukraine (8 %). The top six combined, made up 44 % of all imports.

In animal and vegetable raw materials (Figure 9) the top two export partners in 2022 were the United Kingdom (18 %) and the United States (15 %) The total of the top six export partners was 52 %. Ukraine (14 %) and Brazil (10 %) were the top import partners. The total of the top six import partners was 54 %.

In exports of wood, cork, paper and textiles (Figure 10), China (22 %), the United Kingdom (15 %) and the United States (11 %) were the largest export partners. The top 6 accounted for 63 % of all exports. On the imports side Brazil(21 %) and the United States (15 %) were the main partners. Here the top 6 had a combined share of 60 %.

Almost a fifth of all exports of metals, minerals and rubber (Figure 11) was destined for Turkey (19 %), ahead of China (15 %). The top 6 had a combined share of 62 %. Imports, led by the United States (10 %) and Brazil (7 %) were much less concentrated with the top 6 accounting for only 39 % of all imports.

Source data for tables and graphs

Data sources

EU data comes from Eurostat’s COMEXT database.

COMEXT is the Eurostat reference database for international trade in goods. It provides access not only to both recent and historical data from the EU Member States but also to statistics of a significant number of non-EU countries. International trade aggregated and detailed statistics disseminated from Eurostat's website are compiled from COMEXT data according to a monthly process. Because COMEXT is updated on a daily basis, data published on the website may differ from data stored in COMEXT in case of recent revisions.

European statistics on international trade in goods are compiled according to the EU concepts and definitions and may, therefore, differ from national data published by Member States.

As of January 2022 onwards, data on trade with the United Kingdom is based on a mixed concept. In application of the Withdrawal Agreement Protocol on Ireland / Northern Ireland, for trade with Northern Ireland the statistical concepts applicable are the same as those for trade between Member States while for trade with the United Kingdom (excluding Northern Ireland) the same statistical concepts are applicable as for trade with any other extra-EU partner country. For these reasons, data on trade with the United Kingdom are not fully comparable with data on trade with other extra-EU trade partners, and for reference periods before and after the end of 2020.

Product classification

Raw materials are defined according to the fourth revision of the Standard international trade classification. They include sections 2 Crude materials, inedible, except fuels and 4 Animal and vegetable oils, fats and waxes.

Unit of measure Trade values are expressed in millions (106) or billions (109) of euros. They correspond to the statistical value, i.e. to the amount which would be invoiced in case of sale or purchase at the national border of the reporting country. It is called a FOB value (free on board) for exports and a CIF value (cost, insurance, freight) for imports.

Context

In terms of percentage, the EU is highly dependent on imports of raw materials. For this reason, raw materials security and related strategies have become one of the key priorities in the EU’s external actions and form an integral component of the EU’s interior policy making. The foundations of these strategies were laid in three key documents:

- COM(2008) 699 final ‘The Raw Materials Initiative’;

- COM(2011) 25 final tackling the challenges in commodity markets and on raw materials);

- COM(2014) 297 final on the review of the list of critical raw materials for the EU and the implementation of the raw materials initiative, based in the global economic situation and the EU’s high dependence on imports of certain raw materials.

Direct access to

Notes

- ↑ Unit-value index: Monthly raw data are processed at the most detailed level in order to calculate elementary unit-values defined by trade value/quantity. These unit-values are divided by the average unit-value of the previous year to obtain elementary unit-value indices, from which outliers are detected and removed. Elementary unit-value indices are then aggregated over countries and commodities, by using the Laspeyres, Paasche and Fisher formulae. Finally, the Fisher unit-value indices are chained back to the reference year (2015 = 100).