Businesses in distributive trade sector

Data extracted in January 2024

Planned article update: January 2025

Highlights

(% share of sectoral employment)

Source: Eurostat (sbs_sc_ovw)

This article presents an overview of statistics for the European Union's (EU) wholesale and retail trade and repair of motor vehicles and motorcycles sector (hereafter referred to as distributive trades), as covered by NACE Rev. 2 Section G. It belongs to a set of statistical articles on 'Business economy by sector'. Distributive trades are organized into three NACE divisions: one division deals exclusively with motor vehicles and motorcycles, concretely with their wholesale and retail trade and repair (Division 45; referred to as 'motor trades and repair'). The two other divisions exclude the 'motor trades and repair', and deal either with the wholesale trade of any other good (Division 46; referred to as 'wholesale trade'), or with the retail trade of any other good (Division 47; referred to as 'retail trade').

Full article

Structural profile

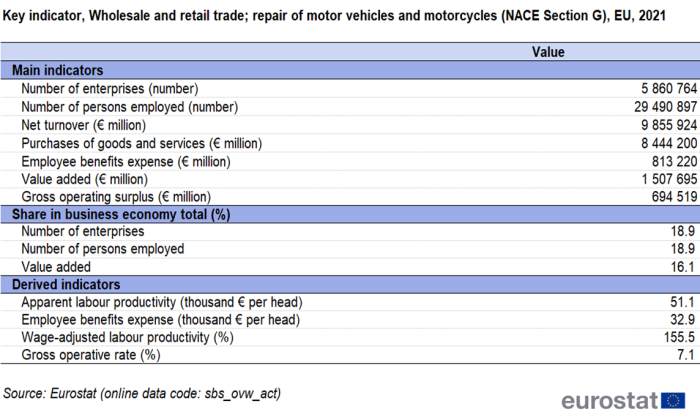

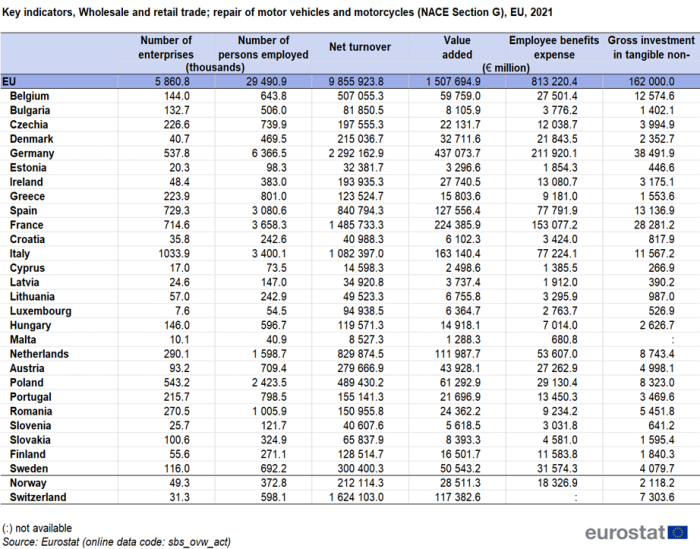

Most distributive trade (Section G) enterprises serve a local market and consequently this sector is characterised by a large number of enterprises: in total almost 5.9 million enterprises were classified to this sector in the EU in 2021, making it the largest enterprise population among any of the NACE sections within the business economy (Sections B to N and P to R, as well as Divisions S95 and S96); the total number of distributive trades enterprises in the EU amounted to 18.9 % of all business economy enterprises.

Source: Eurostat (sbs_ovw_act)

Together these enterprises generated a net turnover (sales) of €9.9 trillion across the whole of the EU in 2021, again the largest value among any of the NACE sections within the business economy and equivalent to almost a third (30.5 %). A similar pattern was observed for employment, as the 29.5 million persons employed within the EU's distributive trades sector accounted for 18.9 % of the business economy employment. Compared with 2020, a year marked by the COVID-19 pandemic, the turnover within the EU's distributive trades sector marked an increase of 12.7 %, while in terms of employment the increase was small, of only 1.0 %. In value added terms, the distributive trades sector was the second largest in the business economy, smaller only than manufacturing (Section C), generating €1.5 trillion of value added in the EU in 2021 (or 16.4 % of the business economy total), an increase of 19.4 % compared with 2021.

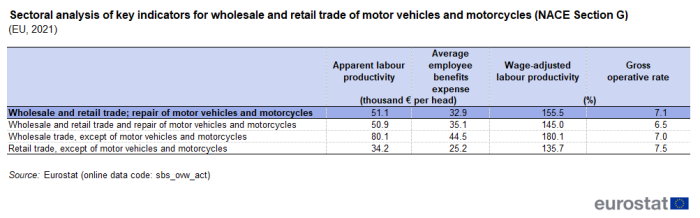

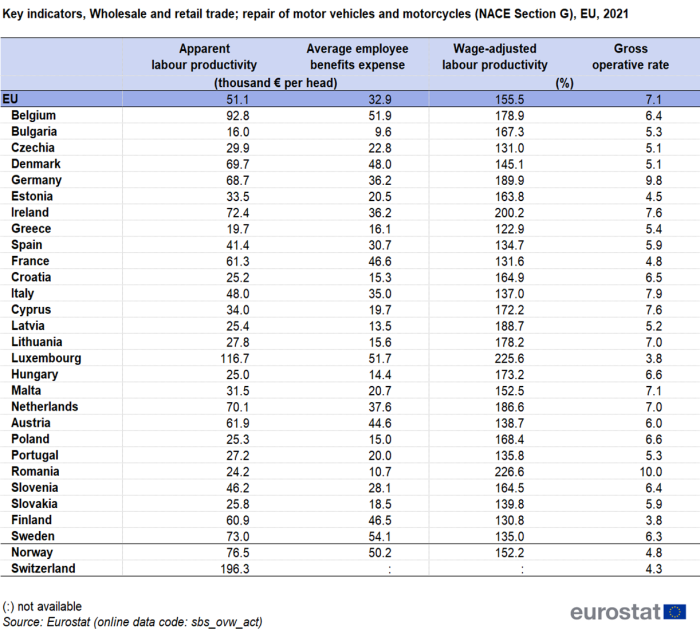

The apparent labour productivity of the EU's distributive trades sector in 2021 was €51 100 per person employed, some €9 000 less per person employed than the business economy average. Average personnel costs (Average employee benefits expense) were €32 900 per employee in the EU's distributive trades sector, also below the average of €39 000 for the business economy. Apparent labour productivity and average employee benefits expense for the distributive trades sector were both among the lowest levels recorded across any of the NACE sections within the business economy in 2021. However, it should be noted that both of these indicators are pulled downwards by the traditionally high incidence of part-time employment in the distributive trades sector. The wage-adjusted labour productivity ratio is not directly affected by the incidence of part-time employment as it shows the ratio between value added and the total employee benefits expense without relating this to the number of persons producing the output or receiving wages and salaries. This ratio is adjusted for the relative importance of unpaid working proprietors and family workers, which is high in some parts of distributive trades, in particular for retail trade activities. The wage-adjusted labour productivity ratio for the EU's distributive trades sector was 155.5 % in 2021, almost the same level as the average for the business economy (154.4 %).

The gross operating rate shows the relation between the gross operating surplus and turnover and is one measure of profitability. The EU distributive trades sector recorded one of the lowest gross operating rate (7.1 %) among the NACE sections within the business economy in 2021, as the level of this ratio was pulled down by the exceptionally high turnover that is an intrinsic characteristic of wholesale and retail trade activities.

Sectoral analysis

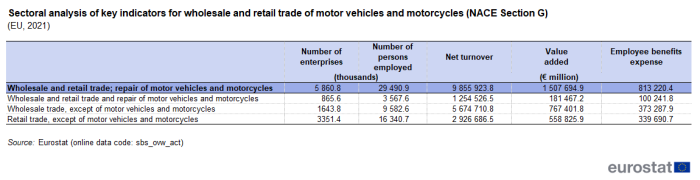

More than half (57.2 %) of the enterprises within the EU's distributive trades sector in 2021 were in the retail trade subsector (Division 47); most of the remainder were in the wholesale trade subsector (Division 46) with 28.0 %, while the motor trades and repair subsector (Division 45) had the smallest share (14.8 %) of the enterprise population within the distributive trades sector. In terms of turnover, the relative size of the retail and wholesale trade subsectors was reversed, as retail trade generated 29.7 % of distributive trades turnover, wholesale trade accounted for more than half, more exactly a 55.4 % share, while motor trades and repair contributed the remaining 12.1 %. Both subsectors of retail trade and wholesale trade recorded the highest employment, turnover and value added among all the other available NACE sections within the EU's business economy.

Source: Eurostat (sbs_ovw_act)

Figure 1 shows a similar analysis of the sectoral structure based on employment and value added within the EU distributive trades sector. The relative importance of the motor trades and repair subsector remained similar to its importance in terms of turnover: 12.0 % of value added and 12.1 % of employment in 2021. By contrast, retail trade had by far the largest share of the sectoral employment (55.4 %), while wholesale trade accounted for the highest share of sectoral value added (50.9 %) in 2021.

(% share of sectoral total)

Source: Eurostat (sbs_ovw_act)

These large differences in the relative size of wholesale and retail trade activities when measured in value added and employment terms underline the significant differences in apparent labour productivity between these two activities — see Table 2b. Apparent labour productivity stood at €34 200 per person employed for the EU's retail trade sector in 2021. This was less than half the productivity level recorded for wholesale trade (€80 100 per person employed). Within the EU's motor trades and repair subsector, apparent labour productivity stood at €50 900 per person employed in 2021, which was close to the distributive trades average (€51 100 per person employed) and €9 300 per person employed less than the business economy average. Average employee benefits expense for the retail trade sector were €25 200 per employee in 2021, which was less than the level recorded for the distributive trades sector as a whole (€32 900 per employee). These relatively low levels of apparent labour productivity and average employee benefits expense recorded for retail trade can to some extent be explained by a high incidence of part-time employment: the use of the wage-adjusted labour productivity ratio takes account of this to a large extent. Despite this, the wage-adjusted labour productivity ratio for the retail trade sector (135.78 %) remained well below the corresponding figure for wholesale trade (180.1 %).

Source: Eurostat (sbs_ovw_act)

Country overview

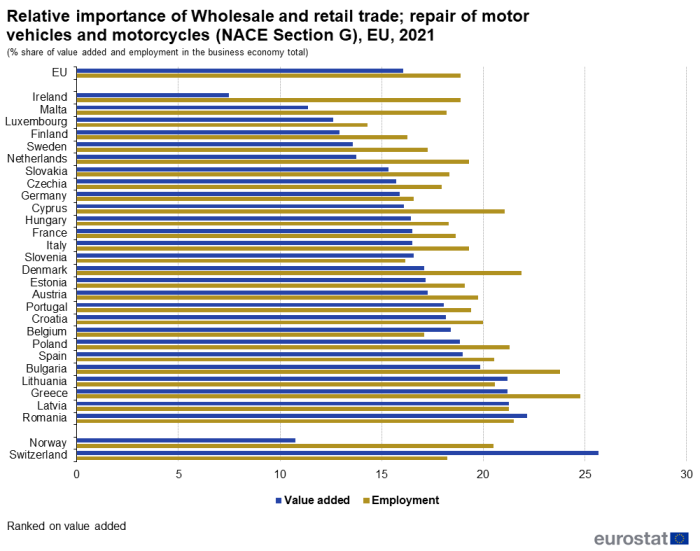

The share of distributive trades in business economy value added in 2021 ranged from 7.5 % in Ireland to 22.2 % in Romania; in Norway the share was higher than in Ireland (10.8 %), in Switzerland it reached 25.7 %. The employment share ranged from 14.3 % in Luxembourg to 24.8 % in Greece. Despite this apparently wide range in the relative weight of the distributive trades sector in the Member States, when taking into consideration that the distributive trades sector is large in absolute terms, the sector as a whole is not one which displays any high degree of specialisation; the buying and reselling of goods is a common place activity that occurs on a daily basis in almost every village, town or city.

(% share of value added and employment in the business economy total)

Source: Eurostat (sbs_ovw_act)

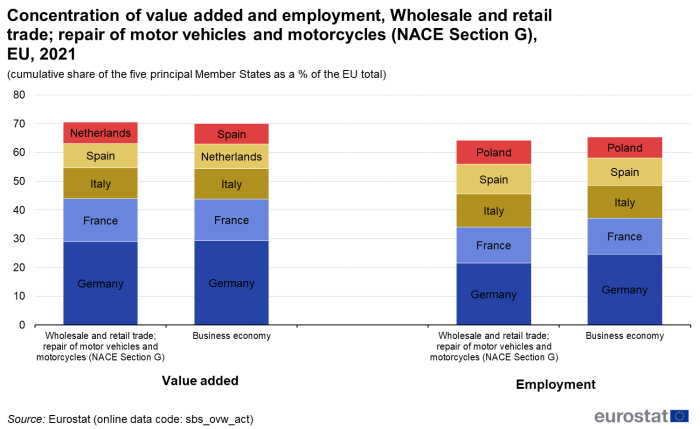

The top five countries contributed to 70.6 % of the EU's value added in distributive trades in 2021, which was in line with EU's business economy as a whole (70.1 %). A similar contribution was recorded for the EU's employment in 2021 where, the top five countries in wholesale and retail trade sector contributed 64.2 %. For the EU's business economy as a whole the top five countries contributed to 65.3 % of employment.

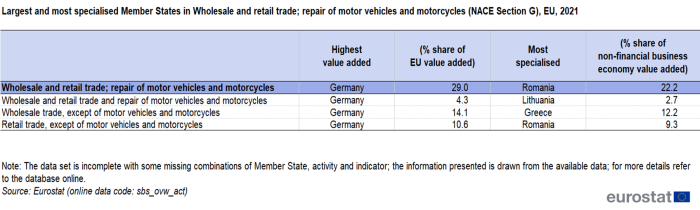

Among the five largest EU Member States, Germany stood out as its distributive trades sector contributed to 29.0 % of the EU's value added in 2021, almost as its 29.3 % share of value added in the EU's business economy as a whole. France recorded the second share (14.9 %) of the value added generated in the EU's manufacturing sector and in the business economy as a whole (14.5 %), being followed by Italy. The same order is kept also for employment.

(cumulative share of the five principal Member States as a % of the EU total)

Source: Eurostat (sbs_ovw_act)

In value added terms, Germany was the largest EU Member State in all subsectors (see Table 3) in 2021. In Greece, the specialisation rate for the wholesale trade was high and amounted to 12.2 % of business economy value added. Equally remarkable was the Romanian specialisation rate retail trade which contributed 9.3 % of business economy value added.

Source: Eurostat (sbs_ovw_act)

Source: Eurostat (sbs_ovw_act)

Among the EU Member States, the highest apparent labour productivity in distributive trade in 2021 was recorded in Luxembourg, where this measure reached €116 700 per person employed. This was quite ahead of the next highest level of apparent labour productivity, namely €92 800 per person employed recorded in Belgium. In Norway and Switzerland the apparent labour productivity in distributive trade was above the EU average. High average employee benefits expense were recorded in Sweden, Belgium and Luxembourg.

Combining these two indicators gives the wage-adjusted labour productivity ratio, which is a measure of labour productivity that takes into account the very different levels of pay and social charges between Member States and activities. The lowest wage-adjusted labour productivity ratios in distributive trade was recorded in Greece (122.9 %). On the other side of the scale, the highest such ratios were recorded in Romania (226.6 %), Luxembourg (225.6 %) and Ireland (200.2 %).

Source: Eurostat (sbs_ovw_act)

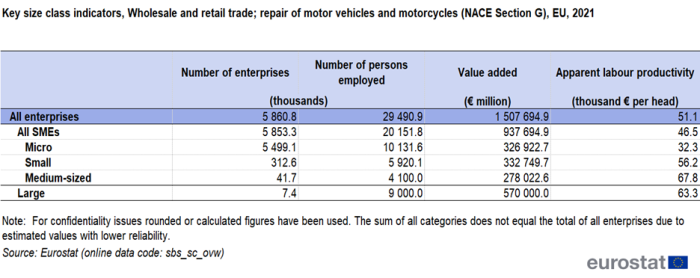

Size class analysis

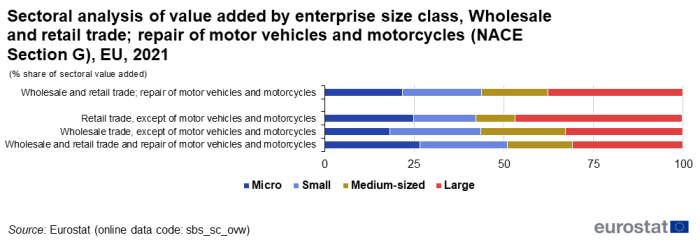

In employment and value added terms, the enterprise size structure of the EU's distributive trades sector is characterized by a smaller role played by small and medium enterprises (employing 10 to 249 persons), complemented by a larger role played by micro (employing less than 10 persons) and large enterprises (employing 250 or more persons). A size class analysis of the distributive trades sector indicates that large enterprises in this sector recorded a higher apparent labour productivity than SMEs (small and medium-sized enterprises). This may, in part, be explained by a high incidence of part-time employment in large distributive trades enterprises, which is often the case for those working atypical working hours or at weekends.

Source: Eurostat (sbs_sc_ovw)

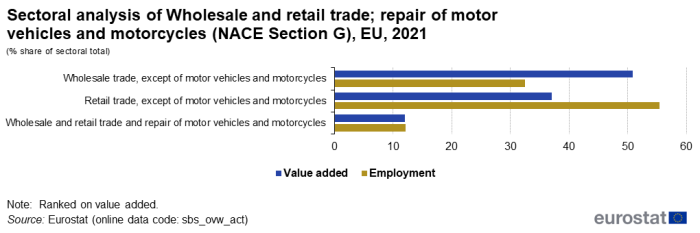

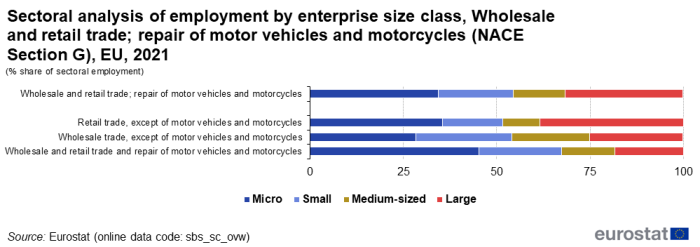

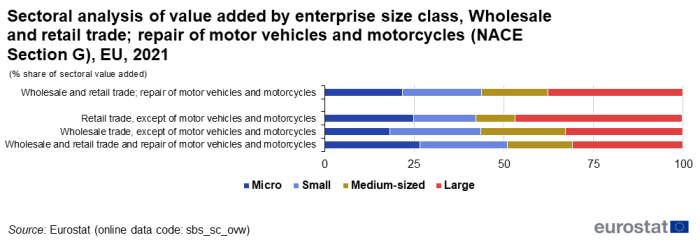

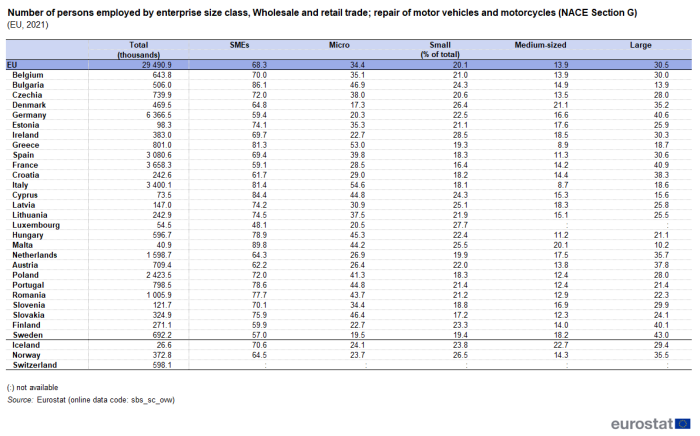

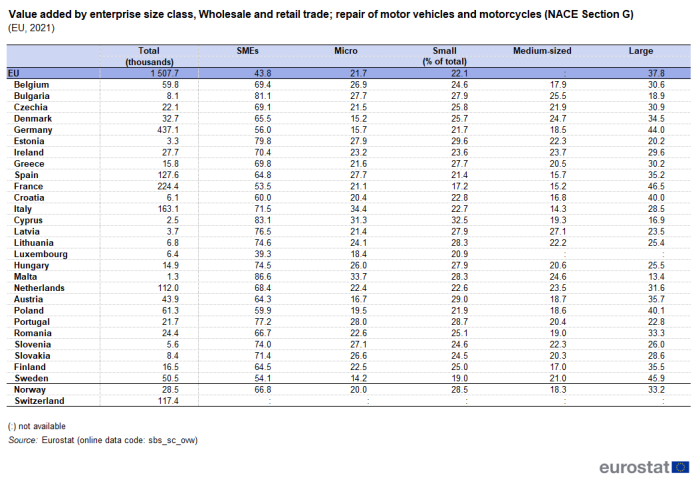

Micro enterprises (employing fewer than 10 persons) had the highest level of employment among the four size groups in two out of three subsectors, the only exception being retail trade, where large enterprises played a slightly more important role - they accounted for more than one-third (38.6 %) of employment - see Figure 4. In terms of value added, the large enterprises had the highest share in all three subsectors, providing 37.8 % of value added for the whole distributive trades sector — see Figure 5.

(% share of sectoral employment)

Source: Eurostat (sbs_sc_ovw)

(% share of sectoral value added)

Source: Eurostat (sbs_sc_ovw)

Among the EU Member States the relative significance of large enterprises was at its greatest in Sweden in 2021, as these enterprises contributed to 43.0 % of the large enterprises employment in the distributive trades sector, being followed by France, Germany and Finland, all with values over 40 %. In terms of value added, in 2021, large enterprises generated the highest share of the total value added in France, Sweden, Germany, Poland and Croatia (all with shares of at least 40 %), while the EU average was 37.8 %.

Source: Eurostat (sbs_sc_ovw)

Source: Eurostat (sbs_sc_ovw)

Source data for tables and graphs

Data sources and availability

Coverage

Distributive trades includes wholesale and retail sale (sale without transformation) of any type of goods; wholesaling and retailing are the final steps in the distribution of merchandise. Sale without transformation is considered to include the usual operations (or manipulations) associated with trade, for example, sorting, grading and assembling of goods, mixing or blending of goods, bottling, packing, breaking bulk and repacking for distribution in smaller lots, storage, cleaning and drying of agricultural products, cutting out of wood fibreboards or metal sheets as secondary activities. Also included in distributive trades are the repair of motor vehicles and motorcycles but not the repair of any other goods. The distributive trades sector does not include any renting activities, for example, the renting of motor vehicles, industrial equipment or household goods. Distributive trades are organized into three NACE divisions:

- Division 45 covers wholesale and retail trade and repair of motor vehicles and motorcycles, as well as their repair; referred to as motor trades and repair;

- Division 46 covers all wholesale trade, except of motor vehicles and motorcycles; referred to as wholesale trade

- Division 47 covers all retail trade, except of motor vehicles and motorcycles; referred to as retail trade

Data sources Structural business statistics cover the 'business economy', which includes industry, construction and many services (NACE Rev. 2 sections B to N, P to R as well as division S95 and S96). Structural business statistics do not cover agriculture, forestry and fishing, nor public administration. Structural business statistics describe the business economy through the observation of units engaged in an economic activity; the unit in structural business statistics is generally the enterprise. An enterprise carries out one or more activities, at one or more locations, and it may comprise one or more legal units. Enterprises that are active in more than one economic activity (plus the value added and turnover they generate, the people they employ, and so on) are classified under the NACE heading corresponding to their principal activity; this is normally the one which generates the largest amount of value added.

The analysis presented in this article is based on the main dataset for structural business statistics (SBS), size class data and regional data, all of which are published annually.

The main series provides information for each EU Member State as well as a number of non-member countries at a detailed level according to the activity classification NACE. Data are available for a wide range of variables.

In structural business statistics, size classes are generally defined by the number of persons employed. A limited set of the standard structural business statistics variables (for example, the number of enterprises, turnover, persons employed and value added) are analyzed by size class, mostly down to the three-digit (group) level of NACE. The main size classes used in this article for presenting the results are:

- small and medium-sized enterprises (SMEs): with 1 to 249 persons employed, further divided into;

- micro enterprises: with less than 10 persons employed;

- small enterprises: with 10 to 49 persons employed;

- medium-sized enterprises: with 50 to 249 persons employed;

- large enterprises: with 250 or more persons employed.

Structural business statistics also include regional data Regional SBS data are available at NUTS levels 1 and 2 for the EU Member States, Iceland and Norway, mostly down to the two-digit (division) level of NACE. The main variable analysed in this article is the number of persons employed. The type of statistical unit used for regional SBS data is normally the local unit, which is an enterprise or part of an enterprise situated in a geographically identified place. Local units are classified into sectors (by NACE) normally according to their own main activity, but in some EU Member States the activity code is assigned on the basis of the principal activity of the enterprise to which the local unit belongs. The main SBS data series are presented at national level only, and for this national data the statistical unit is the enterprise. It is possible for the principal activity of a local unit to differ from that of the enterprise to which it belongs. Hence, national SBS data from the main series are not necessarily directly comparable with national aggregates compiled from regional SBS.

Context

The purchase of motor vehicles is usually the result of a long-term process, the collection of information and comparison between different vehicles and different suppliers. Retailing and repair of motor vehicles are to some extent substitutes, in that the purchase of a replacement vehicle may often be postponed, particularly in times of economic hardship, in favour of repairing an existing vehicle.

Wholesale trade is the resale of new and used goods to retailers, to industrial, commercial, institutional or professional users, or to other wholesalers. Equally, it includes acting as an agent or broker in buying merchandise for, or selling merchandise to, such persons or enterprises. Merchant (or own account) wholesalers take title to the goods while brokers and agents trade on a commission or fee basis. In the supply chain, wholesalers are located between producers and users, providing know-how and knowledge in markets for which they have expertise. Competition within the wholesale trade activity is often centered on providing more efficient services or more sophisticated value added services. Wholesalers can provide a range of services from basic storage and break of bulk, sorting, grading and logistics to pre- and post-production operations (for instance, labelling, packaging, bottling and installation).

Retailing is the resale of new and used goods mainly to the general public for personal or household consumption or use. Sales may be made in stores (mainly shops), at stalls or markets, or through other forms such as remote selling (mail order or internet), vending machines or door-to-door sales persons. Most retailers take title to the goods they sell, but some act as agents for a principal and sell either on consignment or on a commission basis. Retailing is typically the final stage of distribution between producers and consumers and many of the EU policies affecting this activity concern consumer protection.

In October 2011, a Directive on consumer rights was formally adopted, giving the governments of the EU Member States two years to implement national rules. The Directive aims to make purchases easier and safer, whether in-store or not, and covers a wide range of issues linked to the provision of price information, protection against late delivery and non-delivery, as well as setting out rights on issues such as cooling-off periods, returns, refunds, repairs and guarantees and unfair contract terms. The main benefits for consumers are expected to be:

- the elimination of hidden charges and costs on the internet;

- the banning of pre-ticked boxes on websites;

- increased price transparency;

- a 14-day period for customers to change their mind relating to purchases;

- better refund rights;

- the introduction of an EU-wide model withdrawal form;

- the elimination of surcharges for the use of credit cards and hotlines;

- clearer information on who pays for returning goods;

- better consumer protection in relation to digital products;

- common rules for businesses to make it easier for them to trade all over Europe.

Direct access to

- Recent Eurostat publications on SBS

- Key figures on Europe – 2023 edition – see subchapter on Business

- Eurostat's Regional Yearbook – see chapter 8. Business

- News Release SBS – 2021 final data

Glossary

ESMS metadata files

- Structural business statistics – SBS metadata file