Archive:Activities of head offices and management consultancy statistics - NACE Rev. 2

- Data from October 2015. Most recent data: Further Eurostat information, Main tables and Database.

This Statistics Explained article is outdated and has been archived - for recent articles on structural business statistics see here.

This article presents an overview of statistics for the activities of head offices and management consultancy in the European Union (EU), as covered by NACE Rev. 2 Division 70; hereafter referred to as management services. It belongs to a set of statistical articles on 'Business economy by sector'.

(% share of sectoral total) - Source: Eurostat (sbs_na_1a_se_r2)

(% share of sectoral total) - Source: Eurostat (sbs_sc_1b_se_r2)

Main statistical findings

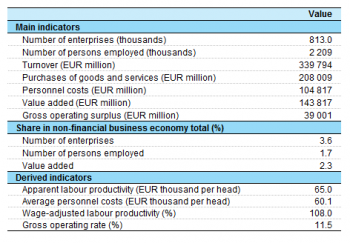

Structural profile

There were 813 thousand enterprises operating with management services (Division 70) as their main activity in the EU-28 in 2012. Together they employed 2.2 million persons, equivalent to 1.7 % of the total number of persons employed in the non-financial business economy (Sections B to J and L to N and Division 95) and 19.2 % of the professional, scientific and technical activities (Section M) workforce. They generated EUR 143.8 billion of value added which was 2.3 % of the non-financial business economy total and 24.0 % of the professional, scientific and technical activities total.

The apparent labour productivity of the EU-28’s management services sector in 2012 was EUR 65.0 thousand of value added per person employed, around 40 % higher than the non-financial business economy average of EUR 46.2 thousand per person employed and also clearly above the professional, scientific and technical activities average of EUR 52.0 thousand per person employed: in fact, this sector had the highest apparent labour productivity among the seven NACE divisions within professional, scientific and technical activities.

Accompanying this high apparent labour productivity was very high average personnel costs, EUR 60.1 thousand per employee for the EU-28’s management services sector in 2012, some 85 % higher than the average for the non-financial business economy (EUR 32.4 thousand per employee) and again well above the average for all professional, scientific and technical activities (EUR 44.3 thousand per employee). The management services sector had the fourth highest average personnel costs among the non-financial business economy NACE divisions in 2012 and the highest ratio among the divisions within professional, scientific and technical activities.

The wage-adjusted labour productivity ratio combines the two previous indicators and shows the extent to which value added per person employed covers average personnel costs per employee. Due to particularly high average personnel costs the EU-28’s management services sector in 2012 had a low wage-adjusted labour productivity ratio, just 108.0 %; this was the joint fourth lowest wage-adjusted labour productivity ratio among all non-financial business economy NACE divisions in 2012 and was also below the professional, scientific and technical activities average (118.0 %); note that only one other professional, scientific and technical activities subsector reported even lower wage-adjusted labour productivity ratio — 98.0 % for scientific research and development (Division 72).

The gross operating rate (the relation between the gross operating surplus and turnover) is a measure of operating profitability. In 2012, the gross operating rate for the EU-28’s management services sector was 11.5 %, somewhat higher than the non-financial business economy average (9.4 %), but considerably lower than the professional, scientific and technical activities average (18.3 %).

Sectoral analysis

The management services sector is composed of two groups, namely activities of head offices (Group 70.1) and management consultancy activities (Group 70.2). In the EU-28, the management consultancy activities subsector was by far the largest of these two subsectors and in 2012 contributed just over two thirds (71.1 %) of sectoral value added and just under three quarters (73.1 %) of sectoral employment — see Figure 1.

The high apparent labour productivity figure for the whole of the EU-28’s management services sector in 2012 was the result of productivity levels that were well above the non-financial business economy average in both subsectors: EUR 70.0 thousand per person employed for head office activities and EUR 63.0 thousand per person employed for management consultancy activities.

The high average personnel costs recorded for the whole of the management services sector were driven by very high average personnel costs (EUR 78.3 thousand per employee in 2012) for the head office activities subsector, although average personnel costs for the management consultancy activities subsector (EUR 51.4 thousand per employee) were also well above the non-financial business economy average (EUR 32.4 thousand per employee).

The differential between apparent labour productivity and average personnel costs resulted in a wage-adjusted labour productivity ratio of 123.0 % for management consultancy activities, which was slightly above the professional, scientific and technical activities average (118.0 %). By contrast, the particularly high level of average personnel costs for the head office activities subsector resulted in a wage-adjusted labour productivity ratio of just 89.0 %; a ratio below 100 % indicates that average personnel costs per employee were below apparent labour productivity per person employed. Indeed, the wage-adjusted labour productivity ratio for the EU-28’s head office activities subsector was the third lowest among all non-financial business economy NACE groups in 2012 (for which data are available), higher only than the ratios recorded for retail sale via stalls and markets (Group 47.8) and the repair of personal and household goods (Group 95.2).

Gross operating rates for the two subsectors that form the EU-28’s management services sector differed widely in 2012. A negative rate (-1.7 %) was recorded for the head office activities subsector, indicating that personnel costs exceeded generated value added. This was the lowest gross operating rate recorded for the EU-28 among all of the non-financial business economy NACE groups in 2012; note also that the head office activities subsector was the only one among all of the non-financial business economy NACE groups which recorded a negative gross operating rate. For the management consultancy activities subsector, the EU-28 gross operating rate was 22.0 %, more than double the non-financial business economy average (9.4 %) and also above the professional, scientific and technical activities average (18.3 %).

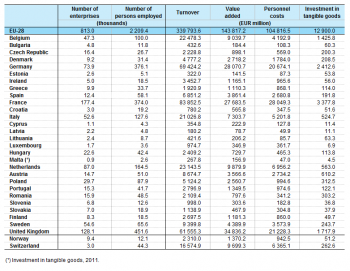

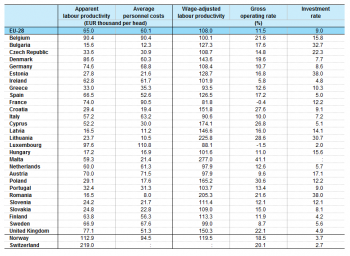

Country analysis

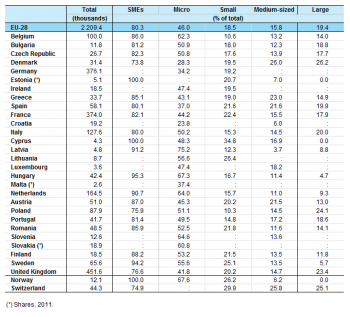

As for most of the professional, scientific and technical activities, the United Kingdom had the largest management services sector among the EU Member States in value added terms with the share of 24.2 % in 2012. It was followed by Germany (19.5 %) and France (19.2 %); the next highest shares were recorded for the Netherlands and Belgium (6.9 % and 6.3 % respectively), while relatively low shares were recorded for Italy (5.1 %) and Spain (2.7 %).

The management services sector accounted for 4.8 % of non-financial business economy value added in Belgium in 2012, compared with a 2.3 % share across the whole of the EU-28. Other EU Member States that were relatively specialised in management services activities included Malta (where this sector accounted for 4.4 % of non-financial business economy value added), the United Kingdom (3.4 %) and the Netherlands (3.2 %). By contrast, in Bulgaria, Spain and Latvia the management services sector contributed less than or equal to 1.0 % of non-financial business economy value added in 2012. Among non-member countries, Switzerland reported a relatively high degree of specialisation for management services activities, as this sector contributed a higher share of non-financial business economy value added (3.2 %) than the EU-28 average, while Norway was the least specialised country in this sector (0.6 %).

The concentration of value added within the United Kingdom, Germany and France was even more pronounced when analysing the information at the subsector level, as Germany and France accounted for 33.4 % and 32.1 % of EU-28 value added within the activities of head offices, while the United Kingdom reported a 33.9 % share of EU-28 value added for management consultancy activities. The most specialised EU Member States for the head office activities subsector were Belgium, Croatia and France, while for management consultancy activities the most specialised countries were the United Kingdom, the Netherlands, Belgium, Sweden and Greece.

Seven EU Member States reported wage-adjusted labour productivity ratios below 100 % for the management services sector in 2012, indicating that average personnel costs per employee were higher than apparent labour productivity; the lowest ratios recorded Luxembourg (88.1 %) and France (81.8 %). The highest wage-adjusted labour productivity ratio within the management services sector was recorded for Malta (277.0 %), followed by Lithuania (225.8 %) and Romania (205.3 %), where ratios for 2012 were considerably higher than in any other Member State — the next highest ratio was 174.1 % in Cyprus. These four countries were also the only EU Member States to record a wage-adjusted labour productivity ratios for the management services sector that were above their ratios for the whole of the non-financial business economy.

By contrast, the gross operating rate for management services was higher than the rate for the non-financial business economy in most of the EU Member States in 2012. Relative to their non-financial business economy averages, particularly high gross operating rates were recorded for management services in Lithuania, Malta, Poland, Belgium, Croatia and Cyprus. There were only four exceptions, where the gross operating rates for management services were lower than their non-financial business economy averages. The biggest difference (9.4 percentage points) was reported for Ireland; although the difference was smaller for France and Luxembourg, these were the only EU Member States to report negative gross operating rates.

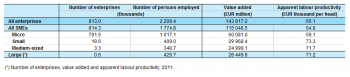

Size class analysis

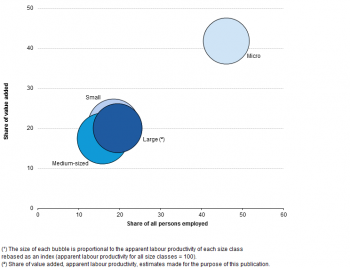

In keeping with many of the professional, scientific and technical activities, the management services sector reported a relatively important role for micro enterprises (employing fewer than 10 persons). There were almost 800 thousand micro enterprises active within the EU-28’s management services sector in 2012. Together they generated EUR 60.1 billion of added value and employed one million persons; as such, they accounted for a 41.8 % share of value added within the EU-28’s management services sector and a 46.0 % share of employment.

The relative shares of the three remaining enterprise size classes were closely matched. In terms of value added they each contributed close to one fifth of the EU-28’s sectoral total, while their shares of employment were slightly lower. As such, the apparent labour productivity of small enterprises (employing 10 to 49 persons), medium-sized enterprises (employing 50 to 249 persons) and large enterprises (employing 250 or more persons) was somewhat higher than the average for the whole of the management services sector, rising to over EUR 70 thousand of value added per person employed for these three size classes. Conversely, the apparent labour productivity of micro enterprises in the EU-28’s management services sector was below the sectoral average, at EUR 59.1 thousand per person employed.

In some of the EU Member States, small and medium-sized enterprises (SMEs, employing fewer than 250 persons) employed the whole of the management services workforce in 2012: this was the case for Cyprus and Estonia (2011 data), and among the non-member countries also the case for Norway. In the majority of the remaining Member States for which data are available, upwards of four out of every five persons employed in the management services sector worked for an SME. The only exceptions were the United Kingdom, Poland and Denmark, where SMEs employed between 70.0 % and 80.0 % of the workforce; this was also the case for Switzerland (74.9 %).

In value added terms, the relative weight of SMEs also predominated, usually accounting for 80 % or more of sectoral value added in most of the EU Member States. Large enterprises accounted for more than one quarter of the value added generated within the management services sector in Portugal, the Czech Republic and Poland in 2012, a share that rose to one third of the total in Italy.

Data sources and availability

The analysis presented in this article is based on the main dataset for structural business statistics (SBS) and size class data, all of which are published annually.

The main series provides information for each EU Member State as well as a number of non-member countries at a detailed level according to the activity classification NACE. Data are available for a wide range of variables.

In structural business statistics, size classes are generally defined by the number of persons employed. A limited set of the standard structural business statistics variables (for example, the number of enterprises, turnover, persons employed and value added) are analysed by size class, mostly down to the three-digit (group) level of NACE. The main size classes used in this article for presenting the results are:

- small and medium-sized enterprises (SMEs): with 1 to 249 persons employed, further divided into;

- micro enterprises: with less than 10 persons employed;

- small enterprises: with 10 to 49 persons employed;

- medium-sized enterprises: with 50 to 249 persons employed;

- large enterprises: with 250 or more persons employed.

Context

This article presents an overview of statistics for the management services sector in the EU, as covered by NACE Rev. 2 Division 70. This division includes the overseeing and managing of other units of the same enterprise (or group), in other words, the activities of head offices. This may involve undertaking the strategic or organisational planning and decision-making role, exercising operational control, and managing the day-to-day operations of related units. This activity includes activities of head offices such as centralised administrative offices, corporate offices, district and regional offices.

Management consultancy activities include the provision of advice and assistance to businesses and other organisations on public relations and communication (including lobbying), as well as issues such as strategic and organisational planning, financial planning and budgeting, marketing objectives and policies, human resource policies, practices and planning, production scheduling and control planning.

This NACE division is composed of two groups:

- activities of head offices (Group 70.1);

- management consultancy activities (Group 70.2).

The information presented in this article does not cover the activities of holding companies, not engaged in managing (considered part of financial service activities, Division 64). Also excluded are legal advice and representation, accounting, bookkeeping and auditing activities, tax consulting (which are classified as part of legal and accounting activities, Division 69), advertising agencies and media representation services and market research and public opinion polling (which form part of the advertising and market research sector, Division 73).

See also

- Other analyses of the business economy by NACE Rev. 2 sector

- Professional, scientific and technical activities

- Structural business statistics introduced

Further Eurostat information

Publications

- European business - facts and figures (online publication)

Main tables

Database

- SBS – services (serv)

- Annual detailed enterprise statistics - services (sbs_na_serv)

- Annual detailed enterprise statistics for services (NACE Rev. 2 H-N and S95) (sbs_na_1a_se_r2)

- SMEs - Annual enterprise statistics by size classes - services (sbs_sc_sc)

- Services by employment size classes (NACE Rev. 2 H-N and S95) (sbs_sc_1b_se_r2)

- Annual detailed enterprise statistics - services (sbs_na_serv)

- SBS - regional data - all activities (sbs_r)

- SBS data by NUTS 2 regions and NACE Rev. 2 (from 2008 onwards) (sbs_r_nuts06_r2)

Dedicated section

Source data for tables and figures (MS Excel)

Other information

- Decision 1578/2007/EC of 11 December 2007 on the Community Statistical Programme 2008 to 2012

- Regulation (EC) No 295/2008 of 11 March 2008 concerning structural business statistics