World trade in services

Data extracted in July 2023.

Planned article update: August 2024.

Highlights

In 2022, the EU was the world’s largest exporter and importer of services.

In 2022, the EU’s trade in services accounted for 30.9 % of the total value of trade in goods and services (this figure relates solely to extra-EU trade, not to trade within the EU).

(%)

Source: Eurostat (bop_eu6_q) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

Globalisation patterns in EU trade and investment is an online Eurostat publication presenting a summary of recent European Union (EU) statistics on economic aspects of globalisation, focusing on patterns of EU trade and investment.

Services are an important part of the global economy and play a central role in each of the EU Member States.

The provision of services contributes a substantial share of the EU’s economic wealth and accounts for more than 50 % of GDP in each of the EU Member States. Nevertheless, the value of exports and imports of goods is generally two to three times higher than that of services. Part of this imbalance may be due to the nature of some services, for example, professional services that are bound by distinct national legislation. Another difference between goods and services concerns the immediacy of the relationship between supplier and consumer: many services are non-transportable, in other words they require the physical proximity of the service provider and consumer, which implies that many services transactions involve factor mobility. For international trade in non-transportable services to take place, either the consumer must go to the service provider or the service provider must go to the consumer. Thus, an important feature of services is that they are provided via various modes of supply. Often services are tailored according to the client’s needs and wishes and so tend not to be homogeneous or mass-produced. As such, services cover a heterogeneous range of products and activities that are difficult to encapsulate within a simple definition, while services may also be difficult to separate from the goods with which they may be associated or bundled. International organisations increasingly recognise that there is a need to explore means of gathering further information as to how services are provided, thus perhaps enabling, in the future, better policy-making internationally and, at the same time, offering complementary information for the purposes of bilateral or multilateral negotiations in trade in services; some first steps have already been undertaken in this direction.

Full article

International trade in services – overview

Statistics on international trade in services

The main methodological references used for the production of statistics on international trade in services are:

- the International Monetary Fund’s (IMF’s) Balance of Payments and International Investment Position Manual (BPM6);

- the IMF’s Balance of Payments and International Investment Position Compilation Guide (BPM6 CG);

- Eurostat’s BoP Vademecum reference document for the transmission of data on international trade in services;

- the United Nations’ Manual on Statistics of International Trade in Services (MSITS 2010);

- the extended balance of payments services classification (EBOPS 2010);

- GATS – General Agreement on Trade in Services;

- MSITS Compilers Guide 2010.

All of the international trade in services statistics presented in this online publication are based upon the BPM6 methodology, adopted by the EU Member States from reference year 2013 onwards. A time series exists starting in 2010 for the EU aggregate, as Eurostat has estimated missing values for 2010 to 2012 when they have not been provided by Member States. Less detailed services data, used as components for the quarterly balance of payments, are available for the EU since 1999, with even longer time series available for some Member States.

EU is the world’s largest exporter and importer of services in 2022

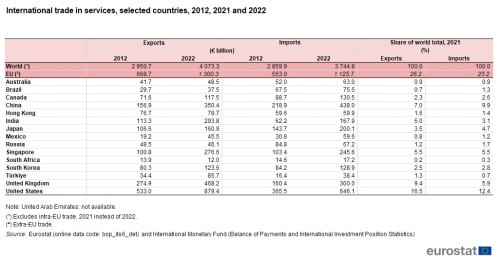

In 2022, the EU was the world’s largest trader of services. Its exports of services were valued at €1 300 billion and its imports at €1 126 billion. Based on 2021 data for world trade in services, the EU accounted for more than one quarter of global exports (26.2 %) and global imports (25.2 %). For comparison, the shares of the United States were 16.5 % for exports and 12.4 % for imports, while those for China were 7.0 % for exports and 9.9 % for imports (see Table 1).

Source: Eurostat (bop_its6_det) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

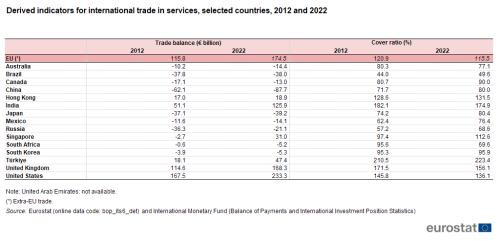

The United States ran the largest trade surplus for trade in services among the trading nations that are shown in Table 2 – some €233 billion in 2022 — while the EU had the second largest surplus (€175 billion), followed by the United Kingdom (€168 billion); aside from these, there were four other countries among those shown in Table 2 that recorded trade surpluses for international trade in services in 2022, namely, India, Türkiye, Singapore and Hong Kong.

In 2022, the highest cover ratios – the value of exports divided by the value of imports, expressed as a percentage – for trade in services were recorded for Türkiye (223.4 %), India (174.9 %) and the United Kingdom (156.1 %), suggesting that the relative importance of service exports was particularly high for each of these economies. Travel services and transport services were particularly important in Türkiye, telecoms, computer and information services in India, and insurance and pension services and financial services in the United Kingdom.

China has a sizeable trade deficit for services in 2022

By contrast, the biggest deficit for international trade in services was recorded by China (€88 billion in 2022). This trade gap was also depicted through the relatively low Chinese cover ratio for services (80.0 % in 2022). There were five countries (among those for which data are shown in Table 2) which had cover ratios for services that were lower than in China: Australia (77.1 %), Mexico (76.4 %), South Africa (69.6 %), Russia (68.6 %) and Brazil (49.6 %).

Source: Eurostat (bop_its6_det) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

In 2022, EU international trade in services accounts for 30.9 % of the total value of trade in goods and services – this share has been rising in recent years

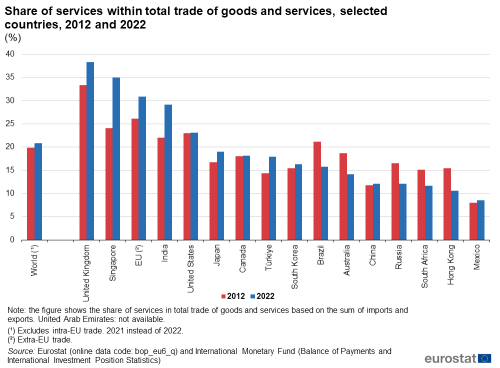

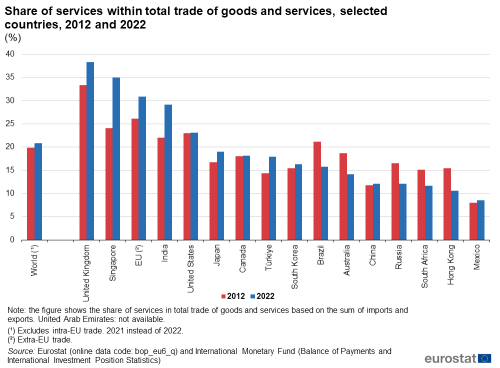

Figure 1 provides an alternative analysis of aggregate figures for services trade, presenting the relative importance of international trade in services compared with the value of trade in goods and services combined (hereafter, total trade). In 2021, services accounted for an average share of 20.8 % of the world’s total trade; this could be compared with a share of 19.9 % in 2012, confirming that services were a growing part of the world’s total trade. Note that this share had been higher prior to the COVID-19 crisis, reaching 24.7 % in 2019. However, the impact of the pandemic led to a dramatic reduction in trade for a number of specific services, such as transport services and travel services.

Within the EU, the relative share of services in total trade also rose, up from 26.2 % in 2012 to 30.9 % in 2022, as international transactions for services became increasingly important to the performance of the EU economy. Prior to the pandemic, the share of services in total EU trade had peaked at 33.1 % in 2018.

In relative terms, the share of services in total trade grew at a quicker pace (than in the EU) in Türkiye, India and most notably Singapore. By contrast, the share of services in total trade contracted quite notably in South Africa, Australia, Brazil, Russia and Hong Kong. For several of these countries, this pattern may be explained, at least in part, by rising prices for primary, energy and agricultural products – in which several of these countries are specialised – resulting in these goods capturing a higher relative share of their total trade.

(%)

Source: Eurostat (bop_eu6_q) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

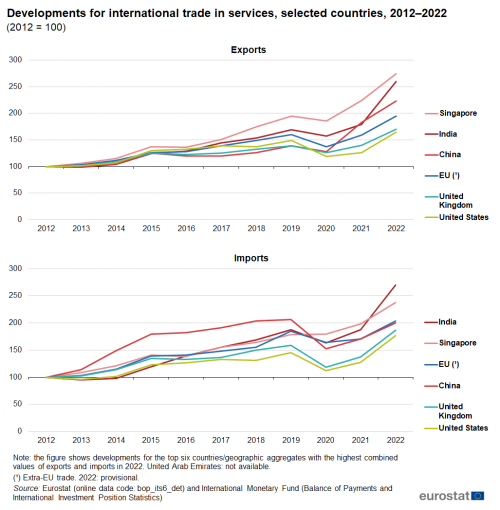

Between 2012 and 2022, Singapore records the fastest growth for trade in services

During the period from 2012 to 2022, the value of EU exports of services increased every year up until the onset of the COVID-19 crisis in 2020. Exports rose from €669 billion in 2012 to €1 072 billion in 2019, before falling to €919 billion in 2020 (down 14.3 %). Exports rebounded in 2021 and 2022, reaching €1 300 billion (up 41.5 % compared with the low recorded in 2020). There was an overall increase of 94.4 % in the value of EU exports of services between 2012 and 2022.

The value of EU imports of services also grew each and every year between 2012 and 2019, before the impact of the COVID-19 crisis led to a fall of 10.9 % in 2020. There was a more modest increase in the value of EU imports of services in 2021 and 2022, such that they were 23.7 % higher in 2022 than in 2020. Overall, imports of services into the EU were 103.6 % higher in 2022 than in 2012 (see Figure 2).

Some of the EU’s global competitors reported even faster rates of growth for the value of their international trade in services. Nowhere was this more apparent than in Singapore and India, where both imports and exports of services were considerably more than twice as high in 2022 as in 2012. Services exports and imports from and to China also at least doubled during this period.

(2012 = 100)

Source: Eurostat (bop_its6_det) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

International trade in services – by service category

Statistics on international trade in services by service category

Since the adoption of the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6), international trade statistics for services have been grouped into 12 main categories: manufacturing services on physical inputs owned by others; maintenance and repair services; transport; travel; construction; insurance and pension services; financial services; charges for the use of intellectual property; telecommunications, computer and information services; other business services; personal, cultural and recreational services; government goods and services. Note that more detailed information is collected for 97 different services and that these data are available in Eurostat’s online database for more in-depth analyses.

In 2022, the EU is particularly specialised in exporting and importing other business services …

Table 3 shows the countries (from a selected list) which recorded the highest levels of trade across each of the 12 main service categories in 2022. As for international trade in goods, the leading global exporters and importers of services, in absolute terms, were unsurprisingly some of the largest economies. The EU had the highest value of exports for more than half of the service categories shown (7 out of the 12). However, the size of the export markets for these different services varied considerably:

- EU exports of other business services (which include, for example, research and development services, legal, accounting, business and management consulting services, advertising, architectural, engineering, scientific and other technical services) were valued at €297.2 billion (equivalent to 22.9 % of all EU exports of services in 2022);

- the smallest of the seven services where the EU had the highest level of exports – maintenance and repair services – had exports valued at €22.3 billion (1.7 % of EU exports of services in 2022).

The five other services where the EU recorded the highest global levels of exports in 2022 were: telecommunication, computer and information services; transport services; travel services; manufacturing services; insurance and pension services.

The EU (also) recorded the highest value of imports for 8 out of the 12 service categories shown in Table 3. The EU’s imports were highest for other business services (€359.2 billion), which accounted for almost one third (31.9 %) of the total value of services imported into the EU in 2022.

(€ billion)

Source: Eurostat (bop_its6_det) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

… while emerging economies quite often record the highest relative specialisation rates for service exports

Table 4 provides an alternative analysis focusing on relative specialisation ratios. The highest ratios were quite often recorded for emerging economies and were spread across a broad range of economies.

- China had the highest specialisation ratio in 2022 for manufacturing services. The share of this category in Chinese exports was 2.6 times as high as the average for the leading trading nations / geographical aggregates for which this analysis is presented.

- India was the most specialised country for exporting telecommunication, computer and information services. The share of this category in Indian exports was more than three times as high as the average.

- Mexico was one of only two economies (the other was Hong Kong) to appear more than once in the ranking of the most specialised exporters for these 12 service categories. It was the most specialised in travel services and in insurance and pension services. Hong Kong featured at the top of the ranking for transport services and for financial services.

(%, average = 100)

Source: Eurostat (bop_its6_det) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

The information presented in Table 5 reverses the focus of the analysis, detailing for each country / geographical aggregate where its relative trade specialisation (among the 12 service categories which form the basis of this analysis) lies. In 2022, the highest export specialisation ratio for the EU was recorded for manufacturing services, while for imports the highest ratio was for charges for the use of intellectual property.

- China, Russia and South Korea were specialised in exports of construction services.

- India was specialised in exports of telecommunication, computer and information services.

- Japan was specialised in exports of charges for the use of intellectual property.

- Mexico, Türkiye and South Africa were specialised in exports of travel services.

- Australia was specialised in exports of personal, cultural and recreational services, as was Canada.

(%, average = 100)

Source: Eurostat (bop_its6_det) and International Monetary Fund (Balance of Payments and International Investment Position Statistics)

Services trade statistics by modes of supply

Statistics on the international supply of services by mode of supply are being developed primarily to meet the needs of the General Agreement on Trade in Services (GATS) trade negotiators and analysts. Statistics are required to support negotiations and to monitor the impact of services trade agreements.

Services differ from goods in respect of the immediacy of the relationship between supplier and consumer. Many services are non-transportable. In other words, they often require the physical proximity of supplier and customer, as in the case of accommodation services for example.

The ‘EBS Compilers Guide for European statistics on international supply of services by mode of supply (2021 edition)’ provides methodological guidance and practical information to the data compilers, on how to compile of statistics on the international supply of services by modes of supply.

Source data for tables and graphs

Data sources

Tables in this article use the following notation:

| Value in italics | data value is forecasted, provisional or estimated and is therefore likely to change. |

Direct access to

Metadata

- Balance of payments – international transactions (BPM6) (ESMS metadata file – bop_6_esms)

Further methodological information