Foreign direct investment - rates of return

Data extracted in July and August 2023.

Planned article update: August 2024.

Highlights

The rate of return on EU direct investment abroad fell strongly between 2013 and 2015, was stable in 2016, rose to a peak of 5.1 % in 2018, fell back to 3.5 % in 2020 and increased to 4.3 % in 2021.

In 2021, the highest rate of return for investments abroad was for FDI from Poland (12.4 %), while the highest rate for investments in EU Member States was observed in Finland (11.4 %).

(%)

Source: Eurostat (bop_fdi6_pos) and (bop_fdi6_inc)

Globalisation patterns in EU trade and investment is an online Eurostat publication presenting a summary of recent European Union (EU) statistics on economic aspects of globalisation, focusing on patterns of EU trade and investment.

This article analyses the returns that investors obtain from foreign direct investment (FDI).

As with all enterprises, economic theory suggests that enterprises which invest abroad will seek to maximise their profits. However, if they are based in more than one country then multinational enterprises have a degree of flexibility that may allow them to adapt their global strategy to reflect the economic conditions in different markets. Their behaviour is further complicated by an opportunity to engage in complex financial flows and transfers between different cost centres (often designed to lower their exposure to, among other things, corporate taxation).

The three analyses presented in this article – overall developments, an analysis by activity and an analysis by EU Member State – are based on the latest data available: for the overall analysis, the most recent reference period is 2021; for the analysis by Member State, the most recent reference period is also 2021; for the analysis by activity, the latest reference period is 2020. Rates of return on FDI may differ considerably between 2020 and 2021, due in part to the developments during the COVID-19 pandemic.

Note, the overall analysis is for the EU's FDI relations with non-member countries (also referred to as extra-EU FDI). The analysis by activity and for each EU Member State includes not only extra-EU FDI but also the FDI between Member States (also referred to as intra-EU FDI).

Full article

General overview

The rate of return on EU direct investment abroad rose in 2021

Changes over time in rates of return reflect changes in the level of the stock of FDI and in the related investment income. The level of net income received from non-member countries on outward stocks of FDI increased in 2021 to €404.8 billion, up 33.5 % compared with the year before. As the stock of outward positions rose by 6.2 % in the same year, the rate of return on EU investment abroad increased, up from a low of 3.5 % in 2020 to 4.3 % in 2021.

Net income paid to non-member countries on their FDI positions in the EU increased to €366.6 billion in 2021. This income grew at a faster pace (up 19.5 %) than the stock of inward FDI (up 3.3 % in the same year) and as a consequence the rate of return on inward FDI increased from 4.2 % in 2020 to 4.8 % in 2021. The rate of return for direct investment in the EU in 2021 was slightly lower than the peak rate in 2018 (5.2 %), but higher than in any other year during the period shown in Figure 1.

(%)

Source: Eurostat (bop_fdi6_pos) and (bop_fdi6_inc)

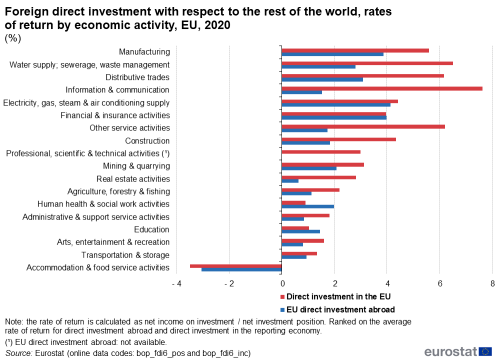

EU FDI rate of return by activity

In 2020, the highest rate of return for EU investment abroad was for electricity, gas, steam and air conditioning supply

In 2020, the EU's highest rates of return for outward FDI [1] were recorded for electricity, gas, steam and air conditioning supply (4.1 %), for financial and insurance activities (4.0 %) and manufacturing (3.9 %) – see Figure 2. Positive rates of return were recorded for most of the remaining activities, with the only negative rate being recorded for accommodation and food service activities (-3.1 %), which were particularly impacted by the pandemic.

The highest rate of return for foreign investors in the EU was recorded by those having invested in the category of information and communication (7.6 %). Somewhat lower rates of return were recorded for inward investment in the EU's water supply, sewerage, waste management activities (6.5 ), other service activities and distributive trades (both 6.2 %), as well as manufacturing (5.6 %). As for outward investment, positive rates of return were recorded on inward investment for most of the remaining activities; again, accommodation and food service activities (-3.5 %) was the only exception.

(%)

Source: Eurostat (bop_fdi6_pos) and (bop_fdi6_inc)

EU FDI rate of return by investor

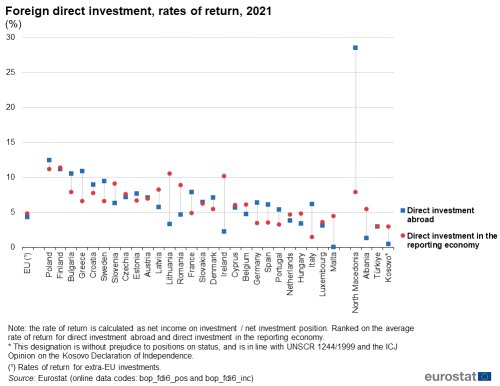

Among the EU Member States, Finland, Poland, Lithuania and Ireland provided the highest rates of return for foreign investors in 2021

While the average rate of return for the EU on investment abroad was 4.3 % in 2021, this ratio reached 12.4 % for outward investment from Poland – see Figure 3. There were also relatively high ratios for outward FDI from Finland (11.2 %), Greece (10.9 %) and Bulgaria (10.6 %). By contrast, the rate of return on outward FDI from Malta was 0.1 %. Note that these values for individual EU Member States are based on all foreign investment, in other words investment in non-member countries and in other Member States.

In 2021, the highest rates of return for foreign investors (made by investors from non-member countries and investors from other EU Member States) were recorded in relation to inward investment in Finland (11.4 %), Poland (11.2 %), Lithuania (10.5 %) and Ireland (10.2 %). Foreign investors in 19 of the Member States recorded a rate of return for their inward investment that was higher than the EU average (4.8 %, just from investors from non-member countries). The rates of return for foreign investors were positive in 2021 in all EU Member States, with the lowest rate in Italy (1.5 %).

(%)

Source: Eurostat (bop_fdi6_pos) and (bop_fdi6_inc)

Source data for tables and graphs

Direct access to

Notes

- ↑ The ranking of rates of return by activity may be of lower quality for outward investment than comparable information pertaining to inward investment, as not all of the EU Member States are able to provide a breakdown according to the activity of non-resident enterprises.

- Balance of payments – International transactions (BPM6) (bop_6), see:

- European Union direct investments (BPM6) (bop_fdi6)

Metadata

- Balance of payments – international transactions (BPM6) (ESMS metadata file – bop_6_esms)

- European Union direct investments (BPM6) (ESMS metadata file – bop_fdi6_esms)

Further methodological information