Archive:Building completion statistics - NACE Rev. 1.1

This Statistics Explained article is outdated and has been archived - for recent articles on structural business statistics see here.

- Data from January 2009. Most recent data: Further Eurostat information, Main tables and Database

This article belongs to a set of statistical articles which analyse the structure, development and characteristics of the various economic activities in the European Union (EU). According to the statistical classification of economic activities in the EU (NACE Rev 1.1), the present article covers building completion work, corresponding to NACE Group 45.4, which is part of the construction sector. The activities covered in this article are:

- plastering (NACE Class 45.41);

- joinery installation (NACE Class 45.42);

- floor and wall covering (NACE Class 45.43);

- painting and glazing (NACE Class 45.44);

- other building completion (NACE Class 45.45).

As well as work on new structures, the renovation, repair and maintenance markets are also important for building completion enterprises.

Main statistical findings

Structural profile

Building completion (NACE Group 45.4) was the main activity for around 873.1 thousand enterprises in the EU-27 in 2006. Together, these enterprises employed 2.5 million persons, equivalent to 17.7 % of the construction (NACE Section F) total. The share of paid employees in the workforce was just 68.0 % for the EU-27, well below the construction sector average of 82.2 %, indicating a particularly high proportion of self-employed workers.

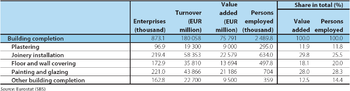

From a turnover of EUR 180.1 billion, the building completion sector generated EUR 75.8 billion of value added in the EU-27, some 14.9 % of the construction sector total. Joinery installation (NACE Class 45.42) was the largest building completion subsector, contributing 29.8 % of the sector's value added, followed by painting and glazing (NACE Class 45.44) with 28.0 %. These two subsectors also had the largest share of the building completion workforce. Floor and wall covering work (NACE Class 45.43) was the third largest subsector with 18.1 % of value added and one fifth (20.0 %) of employment. Other building completion work (NACE Class 45.45) and plastering (NACE Class 45.41) each contributed between 10 % and 15 % of the sector's employment and value added.

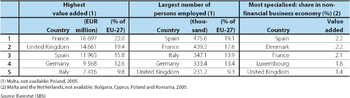

France had the largest building completion sector in value added terms, contributing over 22.0 % of the EU-27 total in 2006. The United Kingdom had the second largest contribution (19.4 %). In terms of employment, Spain and France had the largest building completion workforces, both with well over 400 thousand workers each. The relative importance of the building completion sector was particularly high in Spain, Denmark and France, with this sector contributing more than 2.0 % of non-financial business economy value added in all three of these Member States. In terms of this sector's importance within the construction sector, this was most pronounced in Denmark and France where it contributed 26.0 % and 24.0 % respectively to value added within construction. In contrast, building completion contributed less than 5 % of total construction value added in Slovakia, Romania, Ireland, Estonia and Bulgaria[1].

A number of specialisations among the building completion subsectors can be noted in particular Member States notably: joinery installation contributed 63.9 % of building completion value added in Denmark; painting and glazing contributed more than 50 % of value added in Cyprus, Finland and Sweden; floor and wall covering work contributed 89.8 % of value added in Lithuania; and other building work contributed more than 40 % of value added in Italy and Slovenia.

Expenditure and productivity

The EU-27's building completion sector made EUR 5.0 billion worth of tangible investment in 2006, 10.5 % of the construction total, lower than this sector's share of value added and employment. The investment rate was 6.6 %, which was the second lowest among the construction NACE groups, just above that for building installation. Only in Slovakia and Latvia was the investment rate in this sector higher than the average for construction as a whole[2].

For building completion, the share of personnel costs in total operating expenditure was 30.6 %, the second highest share among construction NACE groups behind the renting of construction or demolition equipment (NACE Group 45.5).

Building completion in the EU-27 recorded apparent labour productivity of EUR 30.4 thousand per person employed in 2006, the lowest of the construction NACE groups and EUR 5.7 thousand lower than the construction average. Average personnel costs in these activities were EUR 27.2 thousand per employee, again the lowest among the construction NACE groups, but just EUR 0.7 thousand per employee lower than the construction average. The low average personnel costs were not enough to compensate for low apparent labour productivity, and as such the wage-adjusted labour productivity ratio was just 112.1 %, clearly the lowest of the five construction NACE groups. Indeed, this was the third lowest wage-adjusted labour productivity ratio among all of the non-financial business economy NACE groups (with 2005 or 2006 data available), higher only than for two retail trade and repair groups.

This particularly low ratio for the EU-27 reflected the fact that six Member States[3] recorded wage adjusted labour productivity ratios that were below 100 % in 2006, indicating that average personnel costs were higher than apparent labour productivity. This was most notably the case in the Netherlands and Greece where ratios below 90 % were recorded. In contrast, in the United Kingdom and Latvia the wage adjusted labour productivity ratio for building completion exceeded the national average for the whole of the non-financial business economy.

Data sources and availability

The main part of the analysis in this article is derived from structural business statistics (SBS), including core, business statistics which are disseminated regularly, as well as information compiled on a multi-yearly basis, and the latest results from development projects.

Context

Building and civil engineering projects typically take much longer from conception to completion than in many other sectors, and often involve a large number of sub-contracting enterprises with various specialisations. Construction projects are often a key factor in urban regeneration, and also in maintaining or developing transport and communication infrastructure. Nevertheless, construction projects impact upon the environment in a number of ways, notably the change in land use, the consumption of materials and fuel, the production of waste, as well as noise and air emissions.

Another characteristic of construction activity is that it is particularly cyclical, influenced by business and consumer confidence, interest rates and government programmes. The level of confidence among construction enterprises, according to the European Commission's Directorate-General for Economic and Financial Affairs is presented in terms of a balance of positive compared with negative responses. This measure turned positive in July 2006 for the first time since June 1990, peaked in September 2006 and then became negative again in November 2007. During 2008, the fall in construction confidence accelerated and fell particularly strongly in the final quarter of 2008, such that by December 2008 the balance was down to -32.3 %. At the time of writing, with overall economic activity declining in many Member States, major public sector funding for infrastructure projects has been proposed by a number of governments as one means of stimulating activity and creating jobs.

See also

- Construction cost index overview

- Construction statistics - NACE Rev. 2

- Industry and construction statistics - short-term indicators