Archive:Bread, sugar and other food production statistics - NACE Rev. 1.1

This Statistics Explained article is outdated and has been archived - for recent articles on structural business statistics see here.

- Data from January 2009. Most recent data: Further Eurostat information, Main tables and Database

This article belongs to a set of statistical articles which analyse the structure, development and characteristics of the various economic activities in the European Union (EU). The present article covers bread, sugar and other foods, corresponding to NACE Rev 1.1 Group 15.8, which is part of the food, beverages and tobacco sector. The foods covered in this article are:

- bread;

- sugar;

- confectionery;

- other food products (including pasta, tea and coffee, homogenised and dietetic foods).

It should be noted that this article excludes the agricultural activities of growing, farming, rearing and hunting and also fishing (NACE Divisions 1 and 5).

Main statistical findings

Structural profile

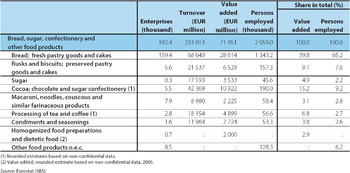

By far the largest of the NACE groups within food, beverages and tobacco manufacturing (NACE Subsection DA) was the bread, sugar, confectionery and other food products manufacturing (NACE Group 15.8) subsector; it consisted of 192.4 thousand enterprises across the EU-27 in 2006, which generated EUR 72.0 billion of value added (36.6 % of the sectoral total) and employed 2.1 million people (43.8 % of the food, beverages and tobacco manufacturing workforce).

Within the bread, sugar, confectionary and other food products sector, the largest activity was the manufacture of bread, fresh pastry goods and cakes (NACE Class 15.81); it generated two fifths (39.8 % or EUR 28.6 billion) of sectoral value added in the EU-27 in 2006 and accounted for two thirds (65.2 % or 1.3 million persons) of the workforce in this sector. The second and third largest activities, namely the manufacture of cocoa, chocolate and sugar confectionery (NACE Class 15.84) and the manufacture of rusks and biscuits, preserved pastry goods and cakes (NACE Class 15.82), together accounted for around a quarter (24.3 %) of value added and 16.9 % of sectoral employment.

Almost two thirds (63.0 %) of the value added generated within the EU-27’s bread, sugar, confectionery and other foods products manufacturing sector in 2006 came from Germany (EUR 13.9 billion), the United Kingdom (EUR 12.5 billion), France (11.0 billion) and Italy (EUR 7.9 billion). In terms of the relative importance of these activities, as measured by their contribution to the value added of the whole of the non-financial business economy, Ireland was by far the most specialised Member State; the bread, sugar, confectionery and other foods products manufacturing sector contributed 4.1 % of Irish value added in 2006, well above the average share (1.3 %) recorded across all of the Member States.

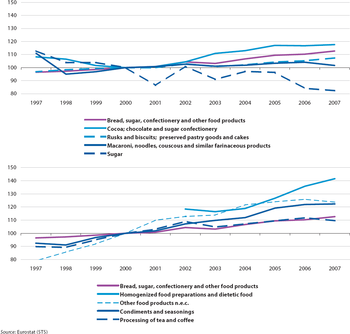

The output of the EU-27’s bread, sugar, confectionery and other foods products manufacturing sector grew, on average, by 1.6 % per year during the ten-year period through to 2007. This was marginally higher than the overall rate for food, beverages and tobacco manufacturing. In the shortened period between 2000 and 2007, the output of homogenised food preparations and dietetic food (NACE Class 15.88) grew across the EU-27 by an average of 5.1 % per year. Otherwise, there was also a high average growth rate for other miscellaneous food products n.e.c. (NACE Class 15.89) – although care should be taken when interpreting this residual category, as it is likely that any new products that could not be attributed within the NACE would be placed here. There were considerable fluctuations in the level of sugar manufacturing output (NACE Class 15.83) within the EU-27, which masked to some degree an overall downward trend in the level of activity. The decline in output accelerated in 2006, such that production fell by 12.7 % compared with the year before; this could, at least in part, be linked to the lowering of sugar quotas within the EU’s agricultural sector.

Expenditure and productivity

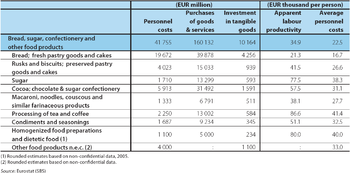

Personnel costs within the EU-27’s bread, sugar, confectionery and other food products manufacturing sector represented a much higher proportion of total operating expenditure than was the case across the food, beverages and tobacco manufacturing sector in 2006 (20.7 % compared with 13.8 %). Average personnel costs (EUR 22.5 thousand per employee) were among the lowest in the food, beverages and tobacco manufacturing sector, pointing to a relatively large, but low-paid workforce.

The apparent labour productivity of those working in EU-27’s bread, sugar, confectionery and other food products manufacturing sector was EUR 34.9 thousand per person employed in 2006, almost 20 % lower than the average across the food, beverages and tobacco manufacturing sector. The relatively low average personnel costs in the EU-27’s bread, sugar, confectionery and other food products manufacturing sector, however, resulted in a wage-adjusted labour productivity ratio (155.6 %) that was close to the food, beverages and tobacco manufacturing average (163.0 %) in 2006. Among the Member States, some of the highest wage adjusted labour productivity ratios were recorded for Ireland (627.6 %) and the United Kingdom (221.9 %).

Data sources and availability

The main part of the analysis in this article is derived from structural business statistics (SBS), including core business statistics which are disseminated regularly, as well as information compiled on a multi-yearly basis, and the latest results from development projects.

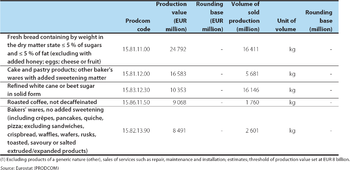

Other data sources include short-term statistics (STS) and the PRODCOM statistics on the production of manufactured goods.

Context

The food, beverages and tobacco manufacturing sector in the EU is comprised of a relatively small number of enterprises that have a considerable global market presence, which operate alongside a high number of relatively small enterprises that serve more local, regional and national markets.

As these enterprises not only produce goods for final consumption but also intermediate products for other manufacturing activities, they are affected by a broad scope of legislation. The main legislative areas affecting the EU’s food, beverages and tobacco manufacturing sector, however, tend to involve international trade agreements, or food and feed legislation. As a majority of the EU’s agricultural production is processed by the food, beverages and tobacco manufacturing sector, developments in Common Agricultural Policy and associated Common Market Organisations can have important implications for costs and processes in the food chain. Regarding food legislation, the European Parliament and the Council proposed an update of the laws regarding the provision of information to consumers (COM(2008) 40 final) in 2008, in order to clarify and consolidate existing regulations. In part, this proposal was built on a 2007 White Paper covering a Strategy for Europe on Nutrition, Overweight and Obesity (COM(2007) 279 final), which stressed the need for consumers to have access to clear, consistent and evidence-based nutritional information.

Sugar is found in many natural foods, but is generally only extracted commercially from sugar beet and sugar cane. Sugar beet production in the EU has been protected for many years by the imposition of tariffs on cane sugar. However, a 2006 reform cut the guaranteed minimum price for EU beet sugar by 36 %, opening-up the EU market to more cane-based sugar from developing countries and, in the process, turning the EU from a sugar exporting region to a sugar importing region. These changes have had an important impact on EU sugar processors, as well as manufacturers of chocolates, biscuits and confectionery, all of which source sugar as an ingredient for use as a sweetener, preservative, flavour enhancer, or bulking agent.

Ensuring that wholesome food is freely available and contributes significantly to the health and well-being of EU citizens, the European Parliament and the Council adopted a common authorisation procedure for food additives, food enzymes and food flavourings in December 2008. The legislation underlines that sweeteners, colourings, preservatives, antioxidants, emulsifiers, gelling agents and packaging gases can only be authorised if they are safe for consumers and if there is a technological need for their use.

Further Eurostat information

Publications

Main tables

Database

Dedicated section

Other information

- COM(2007) 279 final - A Strategy for Europe on Nutrition, Overweight and Obesity related health issues

- Proposal COM(2008) 40 final for a Regulation on the provision of food information to consumers

- Regulation 1331/2008 of 16 December 2008 establishing a common authorisation procedure for food additives, food enzymes and food flavourings