Archive:Air transport sector statistics - NACE Rev. 1.1

This Statistics Explained article is outdated and has been archived - for recent articles on structural business statistics see here.

- Data from January 2009, most recent data: Further Eurostat information, Main tables and Database

This article belongs to a set of statistical articles which analyse the structure, development and characteristics of the various economic activities in the European Union (EU). According to the statistical classification of economic activities in the EU (NACE Rev 1.1), the present article covers air transport sector statistics, corresponding to NACE Division 62, which is part of the transport and storage sector. The activities covered in this article are:

- air transport of passengers and freight on scheduled services (NACE Group 62.1);

- air transport of passengers and freight on unscheduled services (NACE Group 62.2);

- space transport activities (NACE Group 62.3), which is essentially the launching of satellites and space vehicles.

For information on airports see Warehousing and transport logistics statistics - NACE Rev. 1.1.

Main statistical findings

Structural profile

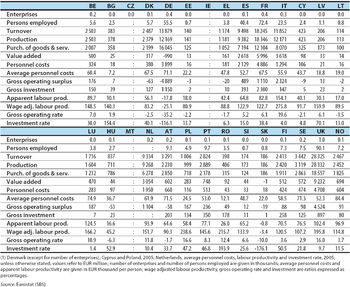

In 2005, there were 3.5 thousand enterprises in the air transport sector (NACE Division 62) in the EU-27. In 2006, the estimated 400.0 thousand persons employed in this sector generated EUR 30 billion of value added, and as such the air transport sector's contribution to the transport services (NACE Divisions 60 to 63) total was 4.5 % for employment and 7.5 % for value added. Paid employees accounted for 99.0 % of all persons employed in the EU-27's air transport sector in 2005, the highest share among the transport services activities presented in the transport and storage sub-sectors, and one of the highest rates among all non-financial business economy NACE divisions in 2005 or 2006.

Three tenths of the EU-27's value added in air transport was generated in the United Kingdom alone, while France's contribution was one fifth. For the third consecutive year Germany recorded a negative value added for air transport in 2006, and this Member State's relative size can be better expressed by its 13.9 % share of the EU-27 workforce.

Luxembourg was by far the most specialised Member State [1] in this sector as air transport represented 3.3 % of non-financial business economy value added, while this share only exceeded 1.0 % in two other Member States, namely Cyprus (2005) and Portugal. Although recent shares of the air transport sector in non-financial business economy value added can not be calculated for Malta and the Netherlands it is likely that these Member States were also relatively specialised in air transport, particularly Malta.

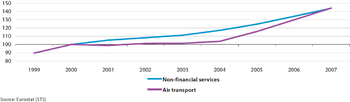

The EU-27's air transport sector recorded low average turnover growth between 2000 and 2004, however in the most recent years for which data are available (2005 to 2007) it has recorded double-digit annual growth each year. Concerning the employment index, air transport in the EU-27 recorded an annual average growth rate of 0.5 % between 1998 and 2007, but this was composed of strong growth in 1999 and 2000, followed by a more gentle decline most years since then, with a 1.0 % increase in 2006 the only significant recent employment gain in this sector.

Transport of goods and passengers

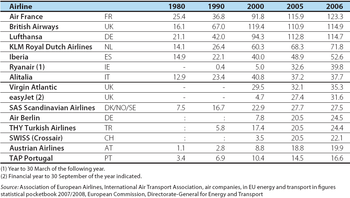

Turning to traffic figures, the United Kingdom accounted for close to one quarter (24.2 %) of all passengers on flights originating or ending outside of the EU-27 in 2007, and Germany just under one fifth (19.9 %). For intra-EU air travel, the United Kingdom again topped the ranking (19.4 % of passengers carried between EU-27 Member States) followed by Spain (15.6 %); Spain had by far the largest market for domestic flights. The volume of passenger traffic (based on passenger kilometres rather than passenger numbers) for a selection of airlines shows that the three largest airlines from France, the United Kingdom and Germany dominated. An analysis of the rates of change between 2005 and 2006 shows an increase for all of the selected airlines except SAS Scandinavian Airlines, with the fastest rates of growth recorded by Ryanair, THY Turkish Airlines and Air Berlin.

Expenditure and productivity

Gross tangible investment by the EU-27's air transport sector in 2005 was valued at EUR 6.7 billion, equivalent to 24.8 % of value added. This investment rate was below the transport services average in the same year (31.2 %) but above the non-financial business economy average (18.0 %). France alone accounted for 26.9 % of the EU-27's investment in this sector in 2005.

The share of personnel costs (21.1 %) in operating expenditure recorded by the EU-27's air transport sector in 2005 was slightly lower than the average recorded for all transport services in the same year (23.4 %). In contrast, average personnel costs were higher, reaching EUR 58.0 thousand per employee in air transport compared with a transport services average of EUR 30.7 thousand. This high figure for average personnel costs was only partly compensated for by higher apparent labour productivity, which reached EUR 75.0 thousand per person employed in 2006. This was reflected in a wage-adjusted labour productivity ratio that was 120.0 % for the EU-27's air transport sector in 2005, below the transport services average of 141.9 % in the same year. Due to their negative value added in this sector Germany and Slovakia both recorded negative wage-adjusted labour productivity ratios for air transport in 2006. These two exceptional cases aside, Hungary recorded the lowest wage-adjusted labour productivity ratio, just 45.2 %, while Estonia, Greece, Lithuania and Austria also registered ratios below parity (100 %), indicating that average personnel costs were greater than apparent labour productivity.

Data sources and availability

The main part of the analysis in this article is derived from structural business statistics (SBS), including core, business statistics which are disseminated regularly, as well as information compiled on a multi-yearly basis, and the latest results from development projects.

Other data sources include short-term statistics(STS), Eurostat air transport statistics and Association of European Airlines, International Air Transport Association, air companies, in EU energy and transport in figures statistical pocketbook 2007/2008, European Commission, Directorate-General for Energy and Transport.

Context

The transport and storage sector focuses on transport services provided to clients for hire and reward. When analysing transport traffic volumes (for example, tonnes of freight) as presented in this article, it is important to bear in mind that these include own account transport as well as transport services for hire and reward. This is particularly important in road transport where, for example, a manufacturer might collect materials or deliver own output, rather than contracting a transport service enterprise to do this. Equally, the use of own vehicles (typically passenger cars) accounts for a very large part of passenger transport. Such own account transport does not contribute towards the statistics on the transport services sector.

EU transport policy is based upon the 2001 White paper ‘European transport policy for 2010: time to decide’ and the 2006 mid-term review in the European Commission's communication (COM(2006) 314) ‘Keep Europe moving – sustainable mobility for our continent’. In 2007 the European Commission adopted a communication (COM(2007) 606) on ‘Keeping freight moving’, to make rail freight more competitive, facilitate modernisation of ports, and review progress in the development of sea shipping.

Environmental issues remain of great importance to this sector, as transport is a major source of emissions and noise. In 2008 the European Commission put forward a package of measures related to road and rail transport referred to as ‘Greening Transport’. This included a communication (COM(2008) 433) summarising the packages and initiatives planned for 2009, a strategy to internalise the cost of transport externalities, a proposal for a Directive on road tolls for lorries, and a communication on rail noise. The overall thrust of the package is to try to move towards more sustainable transport.

The expansion of air traffic has faced criticism, notably because of the growing levels of air emissions and noise from this means of transport, although emissions have grown more slowly than air traffic volumes due to technological improvements. In November 2008 a Directive was adopted (2008/101) to include aviation in the existing emissions trading scheme for carbon dioxide, starting from 2012.

Growth in EU air traffic has occurred during a period of market liberalisation and structural change, with an increased number of operators, particularly low-cost carriers. The development of low-cost carriers has expanded the market for air travel, by offering the possibility of relatively cheap flights for the leisure market. The three largest low-cost carriers in Europe in 2006 in terms of revenue passenger-kilometres were Ryanair, easyJet and Air Berlin. Increased competition, allied with greater costs (notably for fuel), and the rapidly worsening economic climate, have led to a number of airlines struggling to continue operations, with Alitalia, for example, entering administration in 2008 before emerging in a restructured form in 2009.

In September 2008, a Regulation (1008/2008) for air services was adopted, updating legislation from 1992. With the aims of ensuring more competition, and improving quality, it covers a wide range of issues, such as price transparency, oversight of operating licences, market access, aircraft registration, and public service obligations.

Further Eurostat information

Publications

- European Business: Facts and figures - 2009 edition

Main tables

Database

Dedicated section

Other information

- COM(2006) 314 of 22 June 2006 on Keep Europe moving - Sustainable mobility for our continent

- COM(2007) 606 of 18 October 2007 on The EU's freight transport agenda: Boosting the efficiency, integration and sustainability of freight transport in Europe

- COM(2008) 433 of 8 July 2008 on Greening Transport

- Directive 2008/101 of 19 November 2008 to include aviation activities in the scheme for greenhouse gas emission allowance trading within the Community

- Regulation 1008/2008 of 24 September 2008 on common rules for the operation of air services in the Community

External links

See also

Notes

- ↑ Bulgaria, Denmark, Cyprus and Poland, 2005; the Czech Republic, Ireland, Malta, the Netherlands and Romania, not available.