Archive:Accommodation statistics - NACE Rev. 2

- Data extracted in October 2015. Most recent data: Further Eurostat information, Main tables and Database.

This Statistics Explained article is outdated and has been archived - for recent articles on structural business statistics see here.

This article presents an overview of statistics for the accommodation services sector in the European Union (EU), as covered by NACE Rev. 2 Division 55.

(% share of sectoral total) - Source: Eurostat (sbs_na_1a_se_r2)

(% share of sectoral total) - Source: Eurostat (sbs_sc_1b_se_r2)

Main statistical findings

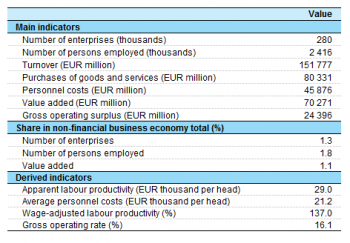

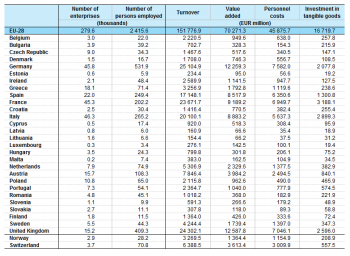

Structural profile

There were 279.6 thousand enterprises operating in the EU-28 in 2012 with accommodation services (Division 55) as their main activity. Together they employed 2.4 million persons, which was equivalent to 1.8 % of the non-financial business economy (Sections B to J and L to N and Division 95) workforce or almost one quarter (23.2 %) of those persons working in accommodation and food services (Section I). Accommodation services generated EUR 70.3 billion of value added which was 1.1 % of the non-financial business economy total or nearly one third (32.9 %) of the added value for accommodation and food services, suggesting that the apparent labour productivity of the accommodation services sector was somewhat higher than that recorded for food and beverage services.

Apparent labour productivity of the EU-28’s accommodation services sector in 2012 was EUR 29.0 thousand per person employed, which was considerably below the non-financial business economy average of EUR 46.2 thousand per person employed, but well above the EUR 20.0 thousand per person employed average for accommodation and food services. This relatively low level of apparent labour productivity was, at least in part, linked to a high propensity for part-time work. The EU-28’s accommodation services sector had the eighth lowest level of apparent labour productivity in 2012 among the NACE divisions that make-up the non-financial business economy.

Alongside relatively low apparent labour productivity, average personnel costs for the EU-28’s accommodation services sector (EUR 21.2 thousand per employee) were also well below the non-financial business economy average (EUR 32.4 thousand per employee) in 2012. As such, the EU-28’s accommodation services sector had the seventh lowest level of average personnel costs per employee across all of the NACE divisions in the non-financial business economy. Again this ratio is influenced to some extent by the high incidence of part-time employment in this sector.

The wage-adjusted labour productivity ratio combines the two previous indicators and shows the extent to which value added per person employed covers average personnel costs per employee. As the divergence between apparent labour productivity and average personnel costs in the accommodation services sector and the non-financial business economy was of a broadly similar magnitude, the wage-adjusted labour productivity ratio for the EU-28’s accommodation services sector in 2012 was, at 137.0 %, relatively close to the non-financial business economy average (142.7 %).

The gross operating rate (which measures the relation between the gross operating surplus and turnover) is one measure of operating profitability; it stood at 16.1 % for the EU-28’s accommodation services sector in 2012, around 1.7 times as high as the non-financial business economy average of 9.4 %.

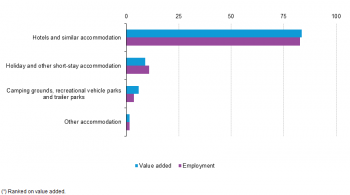

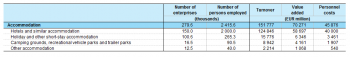

Sectoral analysis

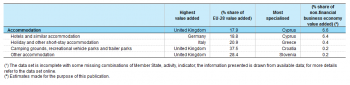

The accommodation services sector in the EU-28 is dominated by the hotels and similar accommodation subsector (Group 55.1), which accounted for 83.5 % of sectoral value added in 2012 and for 82.8 % of the sectoral workforce. There were 150.0 thousand enterprises in the EU-28 that reported hotels and similar establishments as their principal activity in 2012. Together they employed about two million persons and generated EUR 58.7 billion of added value.

The next largest subsector, in terms of value added and employment, was that of holiday and other short-stay accommodation (Group 55.2), which accounted for 11.0 % of the EU-28’s accommodation services workforce and for 9.0 % of sectoral value added. Camping grounds, recreational vehicle parks and trailer parks (Group 55.3) employed 90.5 thousand persons across the EU-28 (some 3.7 % of the accommodation services total), while generating 5.9 % of sectoral value added. The smallest activity (on the basis of a comparison of persons employed or value added) was the miscellaneous category of other accommodation (Group 55.9) which accounted for less than 2.0 % of the EU-28’s accommodation services workforce and value added.

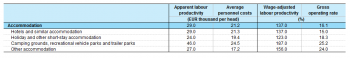

Three of the four accommodation services subsectors recorded a relatively low level of EU-28 apparent labour productivity, lower than or equal to the sectoral average of EUR 29.0 thousand per person employed in 2012. The camping grounds, recreational vehicle parks and trailer parks subsector was the exception to this rule, as apparent labour productivity reached EUR 46.0 thousand per person employed, almost as high as the non-financial business economy average (EUR 46.2 thousand per person employed).

Each of the four subsectors within the accommodation services sector recorded relatively low levels of average personnel costs in 2012, ranging from a high of EUR 24.5 thousand per employee for the EU-28’s camping grounds, recreational vehicle parks and trailer parks subsector to EUR 17.2 thousand per employee for other accommodation. As such, all four subsectors recorded average personnel costs that were well below the non-financial business economy average of EUR 32.4 thousand per employee.

When calculating the wage-adjusted labour productivity ratio the particularly low apparent labour productivity for three of the subsectors were tempered somewhat by the relatively low average personnel costs: the ratio ranged from 123.0 % for the EU-28’s holiday and other short-stay accommodation subsector to 156.0 % for other accommodation. By contrast, the wage-adjusted labour productivity ratio for the EU-28’s camping grounds, recreational vehicle parks and trailer parks subsector, which had a notably higher apparent labour productivity than the other subsectors, was considerably higher (187.0 %) than the non-financial business economy average (142.7 %).

In contrast to the productivity measures, the four subsectors within the EU-28’s accommodation services sector consistently recorded higher than average gross operating rates in 2012. This measure of operating profitability peaked at 25.2 % for camping grounds, recreational vehicle parks and trailer parks, while the lowest gross operating rate was registered for hotels and similar accommodation (15.0 %). Nevertheless, even this rate was more than 1.5 times as high as the EU-28 non-financial business economy average of 9.4 %.

Country analysis

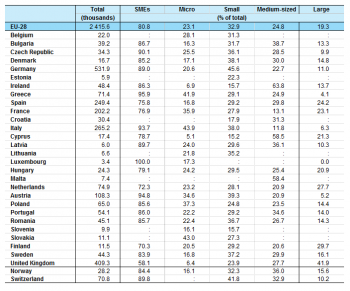

The largest contribution to EU-28 value added within the accommodation services sector in 2012 was made by the United Kingdom (17.9 % of the total). The next highest share of value added was registered by Germany (17.4 %), while France (13.1 %), Italy (12.6 %) and Spain (12.1 %) had very similar shares and were the only other Member States with a double-digit share of EU-28 value added for accommodation services, the next highest share being 5.7 % for Austria. Nevertheless, the 0.7 % share of EU-28 value added recorded for Cyprus within the accommodation services sector was the highest Cypriot share for any of the non-financial business economy NACE divisions (with data available) in 2012, while the Spanish share was its second highest share and the Austrian and Croatian shares their third highest shares.

In employment terms, the relative importance of Germany was higher, accounting for 22.0 % of the EU-28’s workforce within the accommodation services sector in 2012, considerably above the second ranked Member State, the United Kingdom (16.9 %).

At a more disaggregated level, Germany had the highest share of EU-28 value added for hotels and similar accommodation (18.8 %), whereas Italy recorded the highest share for the holiday and other short-stay accommodation subsector (20.9 %). The United Kingdom had the highest share of EU-28 value added for camping grounds, recreational vehicle parks and trailer parks, reaching three eighths (37.5 %) of the total, and for other accommodation, exceeding one quarter of the total (28.4 %).

Cyprus was by far the most specialised EU Member State within the accommodation services sector in 2012, as 6.6 % of Cypriot non-financial business economy value added was generated in this sector. The relative specialisation of Cyprus in accommodation services was 5.8 times as high as the EU-28 average, while Malta, Croatia, Greece and Austria were the other Member States to report that the contribution of the accommodation services sector to non-financial business economy value added was at least twice as high as the EU-28 average. Furthermore, although its relative importance was not so high in value added terms, Ireland reported a relatively high degree of specialisation for the accommodation services sector in terms of employment, as this sector occupied some 4.4 % of the non-financial business economy workforce, the third highest share among the Member States, behind Cyprus (7.7 %) and Malta (6.2 %). Switzerland was also relatively specialised in this sector, with 2.7 % of its non-financial business economy workforce employed in accommodation services.

Looking in more detail, Cyprus also recorded the highest specialisation ratio in value added terms for the hotels and similar accommodation subsector, while Greece was the most specialised country for the holiday and other short-stay accommodation subsector. Croatia and Slovenia were the most specialised Member States for the two smallest subsectors.

The wage-adjusted labour productivity ratios of the EU Member States for the accommodation services sector in 2012 ranged from a high of 199.9 % in Bulgaria to a low of 105.7 % in Sweden. Wage-adjusted labour productivity ratios for the accommodation services sector were lower than non-financial business economy averages in all EU Member States in 2012, with the exception of Bulgaria, Germany, Greece, Croatia and Cyprus.

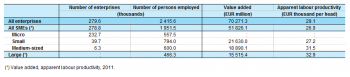

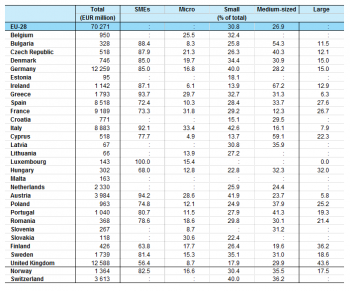

Size class analysis

In comparison with the non-financial business economy as a whole, the accommodation services sector reported a relatively important role for small enterprises (employing 10 to 49 persons). There were 39.7 thousand small enterprises active within the EU-28’s accommodation services sector in 2012. Together they generated EUR 21.6 billion of added value and employed 794 thousand persons. As such, they accounted for a 30.8 % share of value added within the EU-28’s accommodation services sector and a 32.9 % share of employment: the equivalent shares for the non-financial business economy as a whole were 18.2 % and 20.7 % respectively. The share of small enterprises in the accommodation services workforce in 2012 was the second highest share for small enterprises among all non-financial business economy NACE divisions (for which data are available). Medium-sized enterprises (employing 50 to 249 persons) also made a substantial contribution to the accommodation services sector, employing 24.8 % of the workforce and providing 26.9 % of its value added, 7.6 and 8.6 percentage points higher than the equivalent non-financial business economy averages.

Micro enterprises (employing fewer than 10 persons) provided more than one third of the accommodation services workforce in Austria, France, Poland, Greece and Slovakia, and this share peaked at 43.9 % for Italy. These enterprises employed at least one tenth of the accommodation services workforce in all EU Member States (with data available) except for the United Kingdom, Ireland and Cyprus. The latter two Member States had the lowest shares of their accommodation services workforce employed in small enterprises, as low as 15.2 % in Cyprus, while the contribution of small enterprises peaked at 45.6 % in Germany and exceeded one third of the total workforce in another eight Member States. Medium-sized enterprises employed almost six tenths of the accommodation services workforce in Cyprus and Malta (58.5 % and 58.4 %, respectively) and almost two thirds (63.8 %) in Ireland, with shares over one third in a further three Member States. The United Kingdom stood out, as large enterprises employed 41.9 % of the accommodation services workforce, more than double the EU-28 average share (19.3 %) and far above the 29.7 % share in Finland and the 27.7 % share in the Netherlands, which were the only other Member States (with data available) where the share of large enterprises exceeded one quarter.

Data sources and availability

The analysis presented in this article is based on the main dataset for structural business statistics (SBS) and size class data, all of which are published annually.

The main series provides information for each EU Member State as well as a number of non-member countries at a detailed level according to the activity classification NACE. Data are available for a wide range of variables.

In structural business statistics, size classes are generally defined by the number of persons employed. A limited set of the standard structural business statistics variables (for example, the number of enterprises, turnover, persons employed and value added) are analysed by size class, mostly down to the three-digit (group) level of NACE. The main size classes used in this article for presenting the results are:

- small and medium-sized enterprises (SMEs): with 1 to 249 persons employed, further divided into;

- micro enterprises: with less than 10 persons employed;

- small enterprises: with 10 to 49 persons employed;

- medium-sized enterprises: with 50 to 249 persons employed;

- large enterprises: with 250 or more persons employed.

Context

This article presents an overview of statistics for the accommodation services sector in the EU, as covered by NACE Rev. 2 Division 55. The provision of hotels and similar accommodation, holiday and other collective accommodation and recreational vehicle parks, trailer parks and camping grounds includes accommodation typically provided for short stays by visitors.

Hotels and similar accommodation are provided as furnished accommodation in guest rooms and suites, sometimes with kitchenettes; cleaning and bed-making services are generally offered as well as additional services, for example food and beverage services, spa or sports facilities, parking and laundry services. This type of accommodation is provided by: hotels, resort hotels, suite/apartment hotels and motels.

Holiday and other collective accommodation is made-up of self-contained space consisting of complete furnished rooms or areas for living/dining and sleeping, with cooking facilities or fully-equipped kitchens. This type of accommodation is provided through: apartments or flats in small free-standing multi-storied buildings or clusters of buildings, or single storied bungalows, chalets, cottages and cabins. Generally this type of accommodation service provides minimal, if any, complementary services.

The other accommodation subsector includes the provision of temporary or longer-term accommodation in single or shared rooms or dormitories for students, migrant (seasonal) workers and other individuals. This type of accommodation is provided through: student residences, school dormitories, hostels, rooming and boarding houses, or railway sleeping cars.

This NACE division is composed of four separate groups:

- hotels and similar accommodation (Group 55.1);

- holiday and other collective accommodation (Group 55.2);

- recreational vehicle parks, trailer parks and camping grounds (Group 55.3);

- other accommodation (Group 55.9).

The information presented in this article excludes activities related to the provision of long-term primary residences in facilities such as apartments (typically leased on a monthly or annual basis); these are classified as part of real estate activities (Division 68).

See also

- Accommodation and food service activities

- Other analyses of the business economy by NACE Rev. 2 sector

- Structural business statistics introduced

Further Eurostat information

Publications

- European business - facts and figures (online publication)

- Key figures on European Business – with a special feature section on SMEs – 2011 edition

Main tables

Database

- SBS – services (serv)

- Annual detailed enterprise statistics - services (sbs_na_serv)

- Annual detailed enterprise statistics for services (NACE Rev. 2 H-N and S95) (sbs_na_1a_se_r2)

- SMEs - Annual enterprise statistics by size classes - services (sbs_sc_sc)

- Services by employment size classes (NACE Rev. 2 H-N and S95) (sbs_sc_1b_se_r2)

- Annual detailed enterprise statistics - services (sbs_na_serv)

- SBS - regional data - all activities (sbs_r)

- SBS data by NUTS 2 regions and NACE Rev. 2 (from 2008 onwards) (sbs_r_nuts06_r2)

Dedicated section

Source data for tables and figures (MS Excel)

Other information

- Decision 1578/2007/EC of 11 December 2007 on the Community Statistical Programme 2008 to 2012

- Regulation 295/2008 of 11 March 2008 concerning structural business statistics